Introduction

The fintech landscape has been buzzing with activity, and one of the latest headline-grabbing developments comes from Zamp Finance, a rapidly growing AI-powered treasury management platform. The startup has successfully raised $40 million in Series B funding to accelerate its mission of transforming how startups and enterprises manage their cash flows, liquidity, and investments. The funding round marks a significant milestone for Zamp Finance, positioning it as a formidable player in the global fintech and enterprise solutions ecosystem.

Funding Round Details

The $40 million Series B round was led by Accel Partners, with participation from existing investors Sequoia Capital India, Lightspeed, and Tiger Global. This new capital injection brings Zamp Finance’s total funding to over $90 million since its inception in 2021.

According to the company, the funds will be allocated toward:

- Expanding its AI-driven product offerings.

- Scaling operations across North America, Europe, and Asia-Pacific.

- Hiring talent in engineering, AI research, and customer success.

- Strengthening regulatory and compliance frameworks to meet global standards.

What Zamp Finance Does

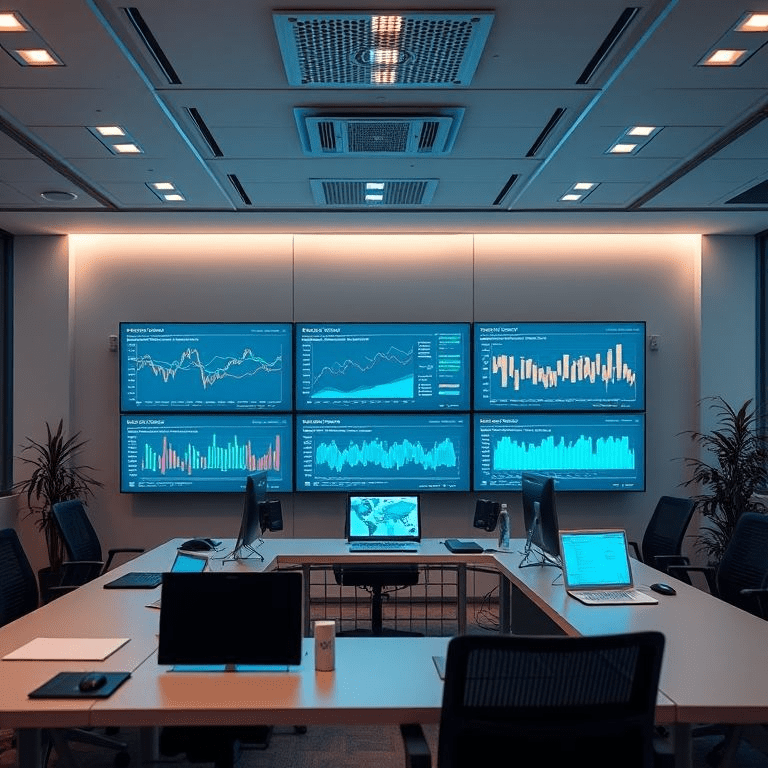

Zamp Finance operates at the intersection of fintech and AI, offering enterprises a centralized platform to:

- Manage liquidity: Optimize working capital across multiple accounts and currencies.

- AI-based treasury forecasts: Predict cash flow needs using machine learning.

- Automated investments: Deploy idle funds into low-risk instruments for yield optimization.

- Compliance automation: Ensure enterprises remain audit-ready and compliant with regional financial regulations.

Its clientele ranges from early-stage startups struggling with fragmented banking to large enterprises seeking smarter automation for treasury operations.

Why This Matters

Treasury management has traditionally been a manual, complex, and error-prone process. Startups often juggle multiple accounts, currencies, and compliance requirements without the tools large banks have. Zamp Finance’s AI-first approach makes treasury more accessible, intelligent, and scalable.

In an interview with TechCrunch, Zamp’s CEO emphasized:

“We want to make treasury management as seamless as using Slack or Notion. Our AI models ensure enterprises don’t just track money but also grow it responsibly.”

Market Context

The global treasury and cash management software market is projected to hit $12.5 billion by 2030, driven by digital-first enterprises and cross-border financial flows. With increasing complexity in compliance (AML, KYC, tax regulations), companies are turning to platforms like Zamp for automation and intelligence.

Reactions from Investors

Accel’s partner, Rajiv Mishra, commented:

“Zamp Finance is redefining financial infrastructure for modern enterprises. Their AI-driven platform solves real problems at scale, and this funding ensures they’re ready to lead globally.”

Competitive Landscape

Zamp Finance competes with established players like Kyriba, Trovata, and Coupa, but its differentiation lies in:

- AI-first core product vs. add-on AI features.

- Startup and SMB focus, while most legacy players target large corporates.

- Faster integration with cloud accounting, banking APIs, and ERP tools.

Future Outlook

With this Series B round, Zamp Finance is expected to:

- Roll out AI-driven investment advisory modules.

- Expand into crypto treasury management, helping firms manage tokenized assets.

- Push further into the U.S. and European markets, where demand for AI-driven treasury solutions is accelerating.

Conclusion

The Zamp Finance funding milestone highlights how fintech startups are using AI to solve long-standing enterprise challenges. As treasury management evolves from spreadsheets to intelligent platforms, Zamp is positioning itself at the center of the transformation.