Introduction

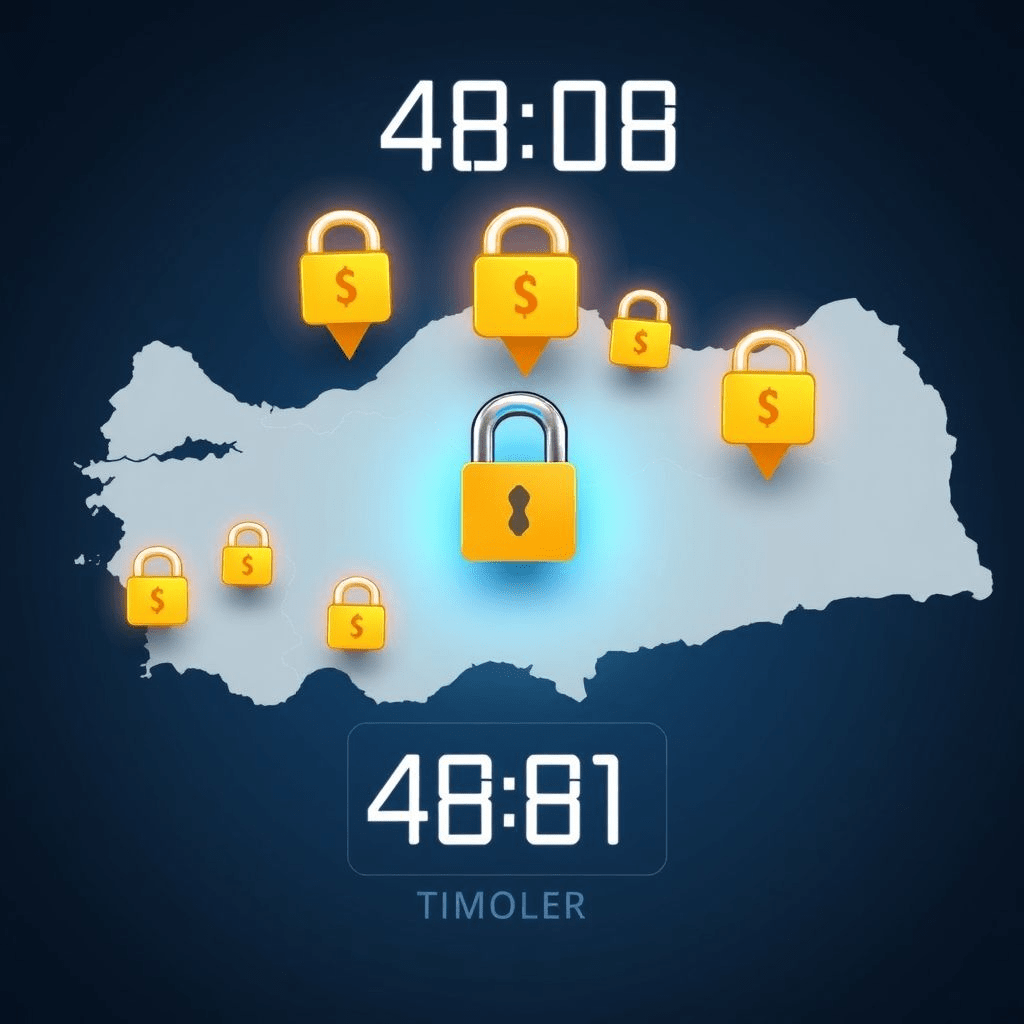

On June 28, Turkish regulators implemented a sweeping set of Turkey crypto rules, imposing withdrawal delays between 48 and 72 hours and capping stablecoin transfers at $3,000 daily and $50,000 monthly. These measures are part of a broader strategy to combat illicit finance in Turkey’s thriving crypto sector.

Policy Details

Under the new framework:

- Crypto withdrawals face a mandatory 48-hour delay for repeat transactions, and 72 hours for first-time withdrawals.

- Stablecoin transfers are limited to $3,000 per day and $50,000 per month.

- Platforms must enforce the Financial Action Task Force’s “travel rule” and attach at least a 20-character transaction memo.

Why the Measures Matter

Turkey ranks among the world’s top crypto markets, but it has faced rising concerns over crypto-based money laundering, fraud, and illegal gambling activities. The new Turkey crypto rules aim to bring local exchanges in line with global AML frameworks while slowing suspicious fund flows.

Industry and Platform Impact

Local crypto exchanges are scrambling to integrate KYC-enhanced systems, withdrawal hold modules, and memo field enforcement. Some smaller platforms have warned that delays may impact user experience, though most agree that compliance is essential to avoid license suspension.

Government and Expert Commentary

Finance Minister Mehmet Şimşek emphasized the need for “administrative, legal, and financial sanctions” for non-compliant platforms. Turkish AML experts view the rules as a necessary step toward global financial integration—even if short-term friction is inevitable.

Investor Implications

Traders must now plan ahead when making large withdrawals, and those using stablecoins need to factor in caps that could affect high-frequency trading strategies. Market liquidity may be temporarily constrained as platforms adapt.

International Parallels

These Turkey crypto rules bring Turkey closer to EU-style standards like MiCA, and align with FATF’s travel rule protocols—signaling regional regulatory alignment.

Next Steps

Exchanges must ensure compliance or risk having licenses revoked. Over time, Turkey may layer in sanctions risk monitoring, enhanced transaction screening, and direct cooperation with international financial watchdogs.

Conclusion

With Turkey crypto rules now in effect, Turkey is signaling that crypto participation comes with accountability. While the rules may slow transactions, they aim to establish long-term trust and market stability. Investors and exchanges should align quickly to comply.