Introduction

Sthyr Energy, a deeptech startup focused on next-generation energy storage, announced a $1 million seed round led by Speciale Invest alongside Antares Ventures. This Sthyr Energy seed funding positions the company to accelerate development of its proprietary battery systems.

Company Background

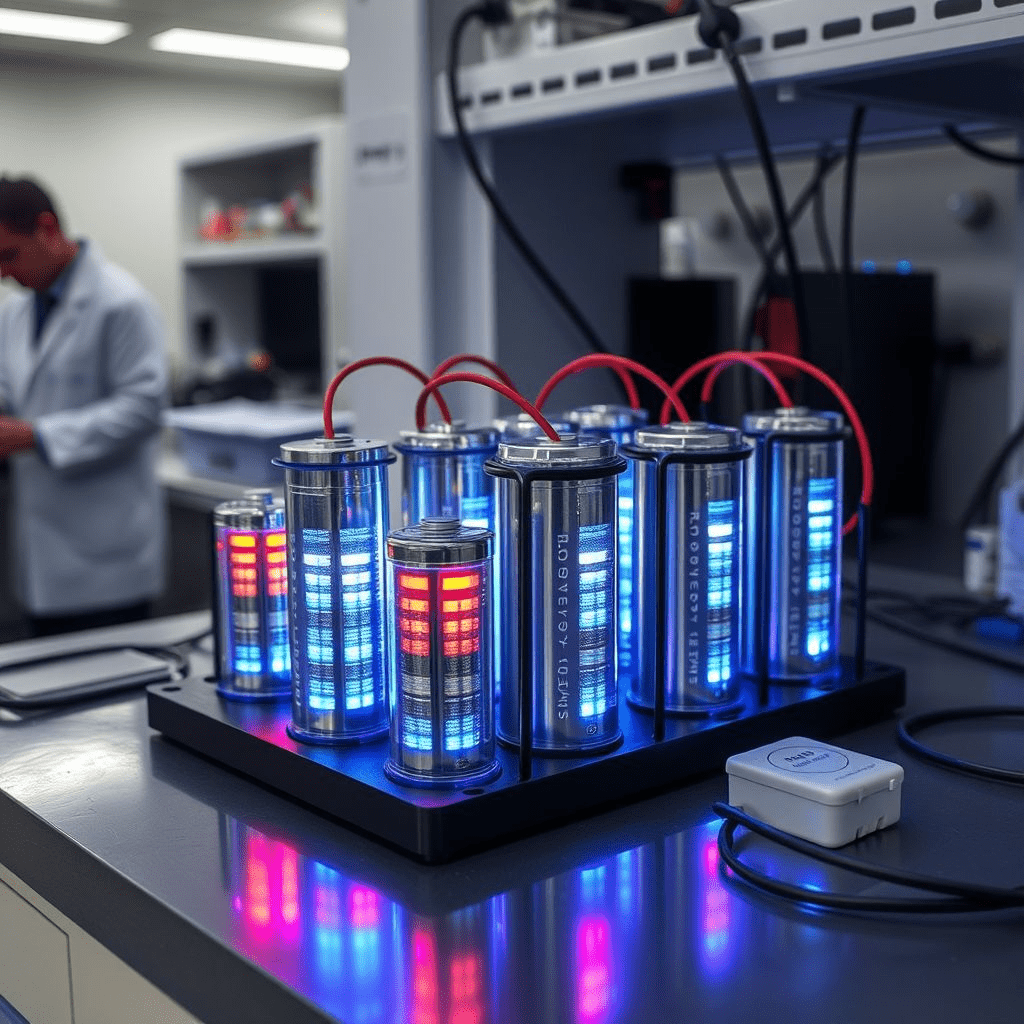

Founded in 2023 by a team of materials scientists and electrical engineers, Sthyr Energy aims to deliver scalable, high-density storage solutions for grid and renewable integration. Its core technology relies on novel composite electrode materials promising longer life cycles and faster charge times.

Details of the Deal

The Sthyr Energy seed comprises a mix of equity from both investors. Funds will be channelled into R&D, prototyping, and pilot partnerships with regional energy providers.

Market Opportunity

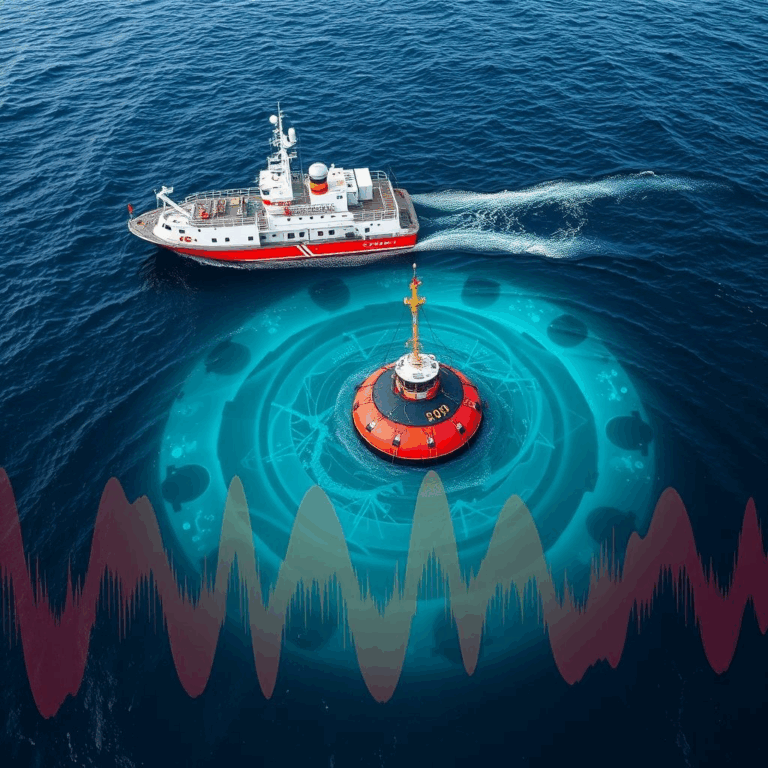

With global battery demand projected to grow at over 20% annually, investors see energy storage as a vital enabler for renewable adoption. Experts note that efficient, cost-effective grid-scale storage remains a barrier to intermittent energy sources like solar and wind.

Investor Perspective

A partner at Speciale Invest said, “Sthyr’s core IP addresses multiple pain points—durability, charge rate, material abundance. It’s rare to see such promise at this stage.”

Growth Strategy

Sthyr has plans to build a pilot production line by Q2 2026 and launch field trials with utilities in Europe and India. The round also supports hiring mechanical engineers and chemists.

Challenges & Risk

Scaling energy storage from lab to production involves high manufacturing overhead, regulatory barriers, and supply chain risks. Sthyr’s credibility will depend on performance data and strategic manufacturing partnerships.

Future Outlook

As the firm iterates, it aims to raise a Series A in 2026 after demonstrating prototype performance metrics like >10,000 charge cycles and sub‑5‑minute full charge times.

Conclusion & Call to Action

The Sthyr Energy seed round showcases investor interest in deeptech battery innovation. Energy utilities, infrastructure funds, and regulators should watch as Sthyr moves closer to commercial readiness.