🌐 A Bold Leap Toward Blockchain-Powered Finance

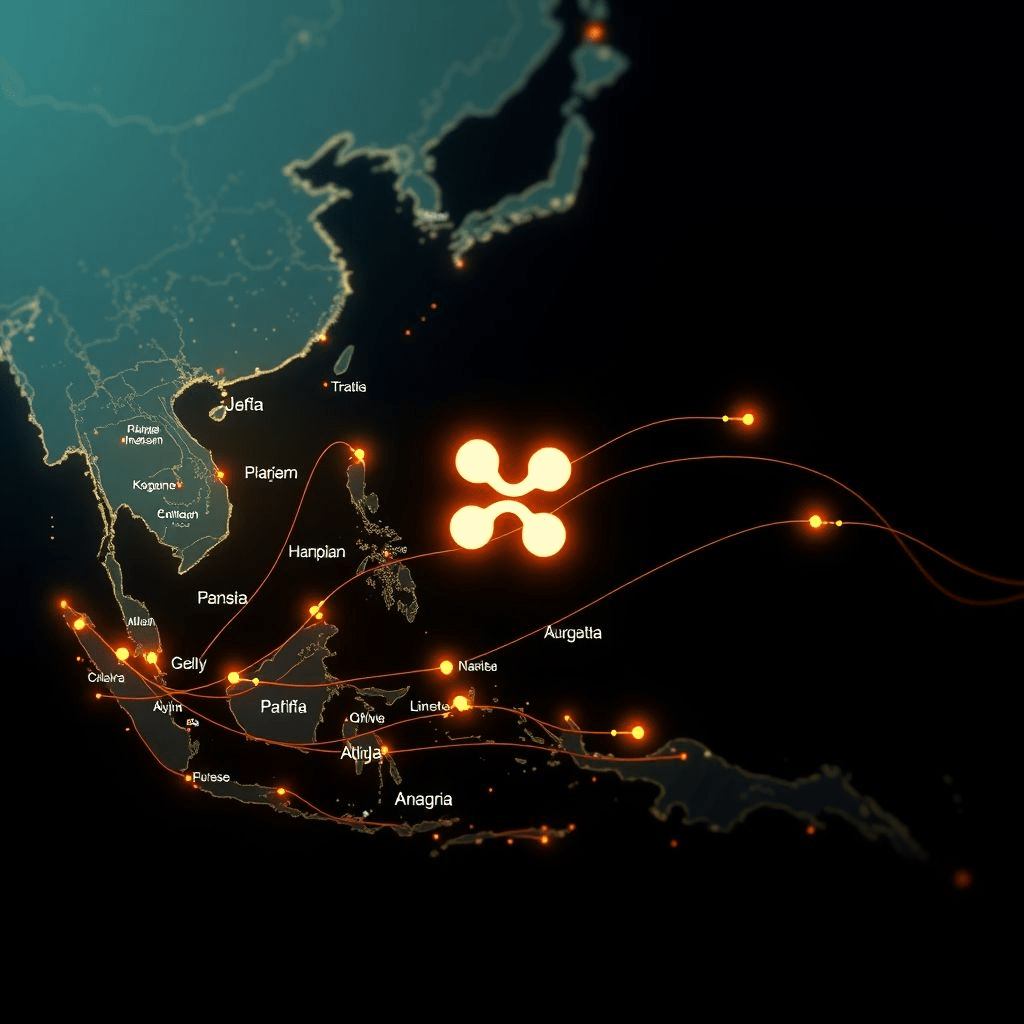

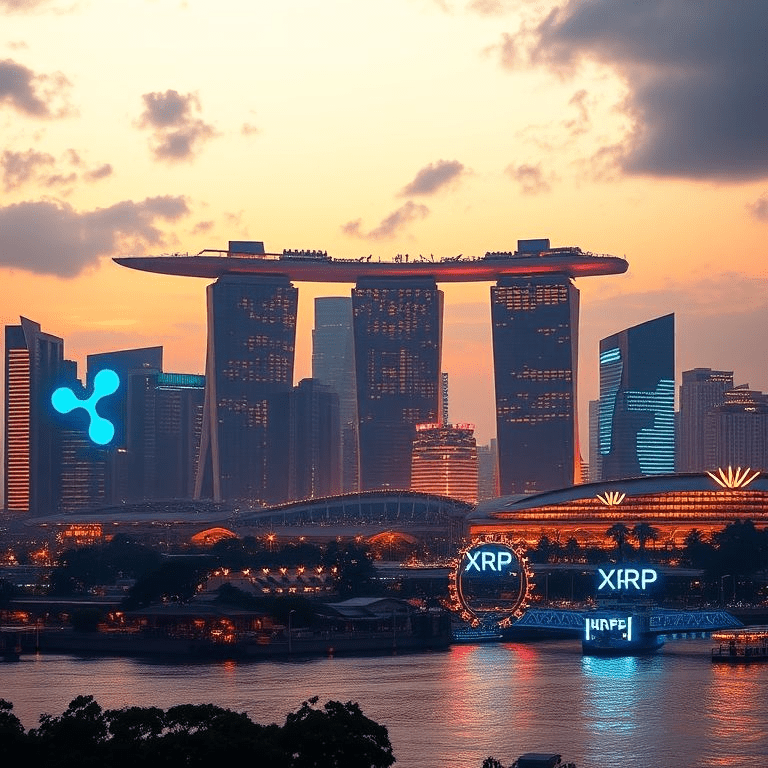

In a landmark move, Ripple Labs has launched its next-gen real-time cross-border payment platform tailored for the Asia-Pacific region, marking a bold escalation in its global fintech ambitions. The service, announced on July 23, 2025, enables instant settlement of international transactions using XRP and RippleNet infrastructure across corridors including Japan, Australia, Philippines, and Singapore.

With traditional banking systems in Asia still plagued by slow, expensive, and opaque international transfers, Ripple aims to leverage its blockchain-based system to offer real-time, low-cost, and secure alternatives—potentially disrupting trillions in remittance flows.

📈 What Happened: Ripple’s APAC Expansion Push

Ripple’s Asia-Pacific initiative is a strategic expansion of RippleNet—its enterprise blockchain network for financial institutions. According to company insiders, the new platform integrates with central banks, commercial banks, and fintech startups across the region.

This includes:

- Real-time gross settlement systems (RTGS)

- Stablecoin interoperability

- XRP-powered liquidity hubs

The platform allows remittance providers and banks to tap into on-demand liquidity (ODL) using Ripple’s native token XRP, enabling faster and cheaper foreign exchange.

Ripple CEO Brad Garlinghouse stated:

“This is a pivotal moment for cross-border payments. Asia-Pacific is leading the future of digital finance, and Ripple is proud to power that evolution.”

💡 Why It Matters: Breaking Through the SWIFT Barrier

Legacy cross-border systems like SWIFT often take 2–5 days to settle transactions, with high fees, middlemen, and limited transparency. Ripple’s blockchain-based rails aim to cut that time to seconds—while reducing costs by over 60%.

Key benefits of Ripple’s new APAC platform include:

- Settlement within seconds, not days

- 24/7 availability, not limited to banking hours

- Significantly lower fees compared to wire services

- Full transaction transparency via blockchain ledger

This marks a significant milestone in Ripple’s shift from legal battles (including the long-standing SEC lawsuit) to enterprise innovation.

🏦 Early Adopters and Institutional Support

The platform is already being piloted or integrated by several banks and fintech companies, including:

- SBI Remit (Japan)

- Tranglo (Malaysia)

- Novatti Group (Australia)

- PayMongo (Philippines)

These institutions are embedding Ripple’s APIs into their systems to settle remittances, e-commerce payments, and payrolls in real-time.

Additionally, rumors suggest that multiple central banks in ASEAN are exploring Ripple as a backbone for future CBDC (central bank digital currency) transfers.

🧠 Expert Opinions

“Ripple is showing how blockchain can modernize the backbone of international finance. Asia-Pacific is the right launchpad given its digital payment leadership,” said Linda Chen, fintech researcher at R3 Consortium.

“Ripple’s infrastructure could enable billions in untapped liquidity across fragmented economies. The impact will be profound if regulators align,” added blockchain policy expert Neeraj Singh.

🌏 Strategic Timing and Regional Focus

Asia-Pacific is not a random choice—it’s a hotbed of crypto innovation and home to some of the highest remittance flows globally:

- India, Philippines, and Vietnam are top recipients of remittances.

- Japan and Singapore are emerging financial hubs with strong blockchain frameworks.

- Australia has rapidly digitized its banking stack with APIs and open banking.

Ripple’s launch aligns with these macro-trends, offering a scalable, interoperable, and crypto-native solution.

🔮 Outlook: Ripple’s Future in Global Finance

The success of Ripple’s APAC platform could set the stage for a global rollout, especially in:

- Latin America (where remittance inefficiency is also severe)

- Africa (a growing hub for mobile and crypto payments)

- Europe (where MiCA regulation may favor Ripple’s compliance-first stance)

However, the ongoing regulatory uncertainty in the U.S. may still limit Ripple’s ability to expand domestically—unless clarity emerges from pending SEC actions.

Despite this, Ripple’s continued XRP liquidity development, expansion of CBDC trials, and enterprise partnerships suggest the company is firmly on track to become a global leader in crypto-finance infrastructure.