Introduction

OpenAI is reportedly negotiating to reduce the percentage of revenue it shares with Microsoft and other commercial partners from the current ~20% down to about 8% by the end of the decade. This recalibration is part of broader changes in OpenAI’s structure, governance, valuation, and partnerships, as it moves toward more autonomy and possibly a public benefit or for-profit corporate model.

Background

- Existing Partnership with Microsoft: Microsoft has been a central partner and investor for OpenAI since 2019, providing billions in funding, cloud infrastructure (Azure), licensing, and collaboration on products like ChatGPT and other AI APIs. Under current terms, Microsoft and other partners receive ~20% of OpenAI’s revenue.

- Rationale for Re-negotiation: As OpenAI scales up, the compute, infrastructure, safety, compliance, and research costs have become massive. Also, there are pressures around maintaining mission alignment, ensuring financial sustainability, attracting capital, and preserving flexibility (e.g. allowing multiple cloud providers). Reducing revenue share would allow OpenAI to retain more income to reinvest in these areas.

What Exactly is Changing

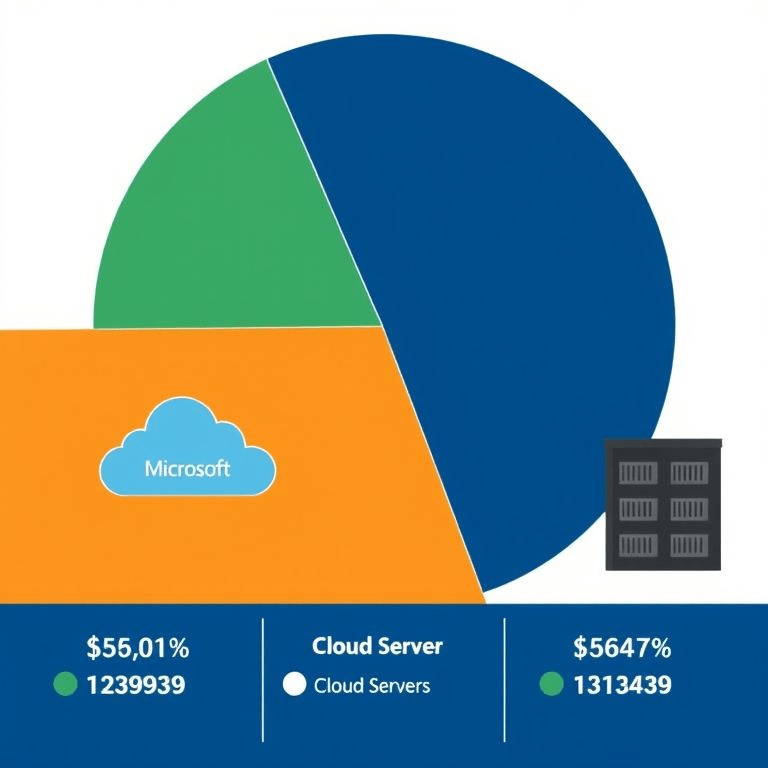

- Revenue Share Shift: From ~20% currently to ≈ 8% for Microsoft and other commercial partners, projected by the end of the decade.

- Financial Implication: The reduction could result in over $50 billion more revenue staying with OpenAI (whether cumulative or annual is not totally clear).

- Server/Infrastructure Fees Negotiations: OpenAI is also renegotiating how much it pays Microsoft for cloud/server rentals. Since Microsoft’s Azure is a big part of its infrastructure backbone, these costs matter a lot.

- Non-Binding Deal & Corporate Restructure: The revenue sharing shift is one piece of a broader non-binding agreement (a memorandum of understanding, or MOU) between OpenAI and Microsoft. Other parts include changing OpenAI’s for-profit / nonprofit relationships, granting a big equity stake to the nonprofit parent, possibly turning the for-profit arm into a Public Benefit Corporation (PBC), etc.

Reactions & Expert Views

- From OpenAI / Microsoft: Both companies have not formally confirmed all details. Much of this is reported via The Information and Reuters based on sources. They have acknowledged work toward definitive agreements based on the MOU.

- Analysts’ Take: Some believe this gives OpenAI more financial breathing room—letting it hold on to more profits that can be reinvested into safety, model development, compute expansion, etc. But there are trade-offs: Microsoft may see reduced returns or need to adjust its expectations for income from OpenAI. Also, renegotiating infrastructure costs could lead to new tensions.

- Regulatory / Mission-Concern Observers: There is scrutiny about how reducing partner revenue share, while shifting equity, changing governance, etc., could affect OpenAI’s nonprofit mission. Regulators in states like California and Delaware are already investigating how restructuring might impact charitable or nonprofit assets and control.

Impact

- On OpenAI: Retaining more revenue means more funds to deploy for infrastructure/capacity, faster R&D, safety, broader compute access, better product quality. It could also help OpenAI be less dependent financially on Microsoft.

- On Microsoft & Partners: Lower share from revenue could reduce Microsoft’s direct financial returns from the partnership, but Microsoft might make up via service fees, infrastructure rentals, or other value-added components. The renegotiation of Azure server fees will be key.

- Market & Valuation Effects: Investors may view the move favorably if OpenAI seems more financially self-sufficient and transparent. But also, valuation and obligations (e.g., what investors expect in returns) will depend heavily on the final structure.

- Competition and Industry Precedent: Other AI firms might seek similar arrangements with their infrastructure/partner providers. More broadly, this could shift how AI cloud-compute partnerships are structured.

Future Outlook

- Definitive Agreements: As of now, the deal is non-binding. Final contracts will clarify how “revenue” is defined, what counts as a partner, what services are covered, etc.

- Implementation Timeline: The target is by the end of the decade (so there is time); but how gradual the transition will be matters—e.g. will the 20% reduce gradually over several years, or move suddenly.

- Regulatory Oversight: State and possibly federal oversight might require that changes preserve the nonprofit mission, especially as assets, governance, and control shift.

- Compute & Infrastructure Negotiations: How much OpenAI pays Microsoft (and possibly other providers) for servers / cloud / data center usage will be pivotal. These costs are significant.

- Public Perception / Trust: Moves like this affect how stakeholders (users, governments, ethicists) view OpenAI’s commitment to safety, fairness, mission alignment. Transparency will matter.

Conclusion

The proposed shift in OpenAI revenue sharing—dropping from around 20% to ~8% for Microsoft and other commercial partners—is part of a broader restructuring in governance, equity, and corporate mission. If executed well, it could yield financial stability, more reinvestment in safety, and a stronger position in global AI competition. But success will depend heavily on the details: how “partner revenue” is defined, how infrastructure costs are handled, how the nonprofit parent’s mission is preserved, and how regulatory scrutiny plays out.