Introduction

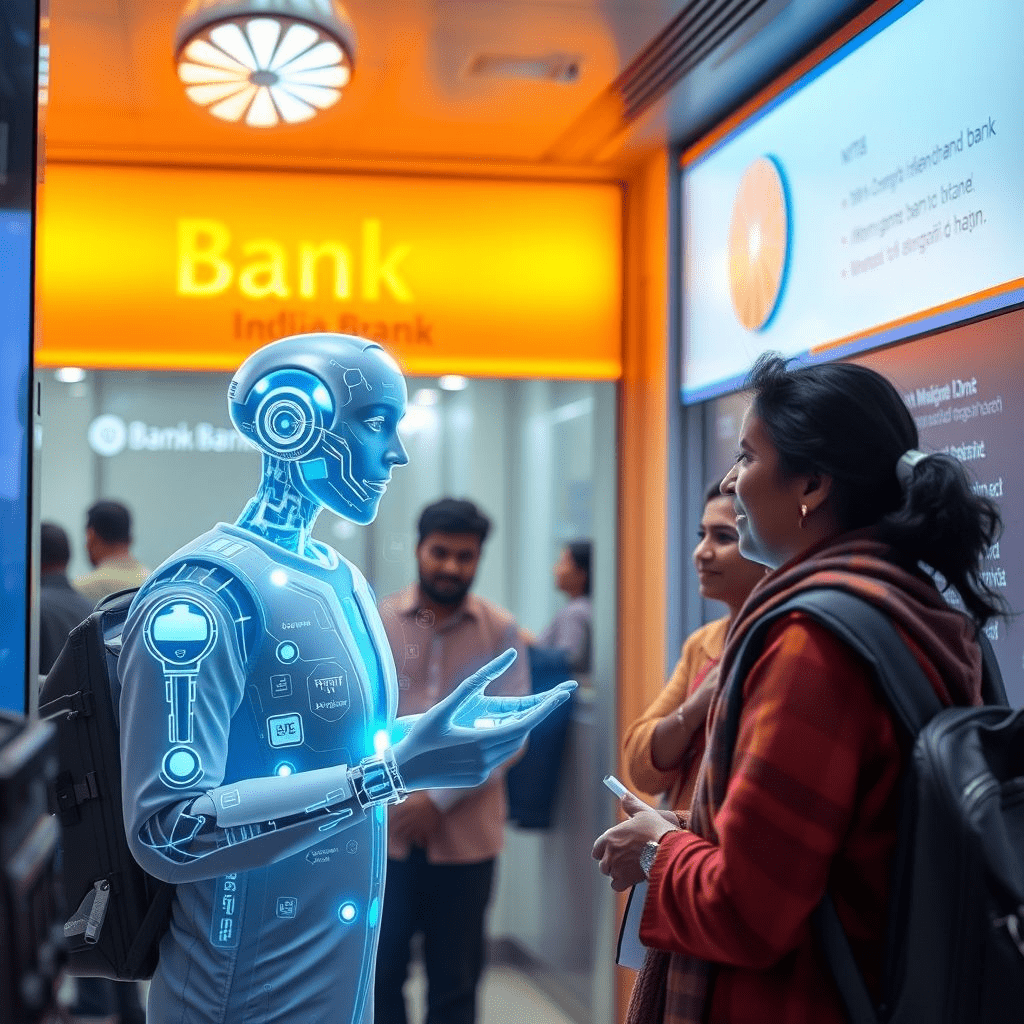

In a move that signals the rapid convergence of finance and artificial intelligence, HDFC Bank has made a strategic generative AI banking investment in CoRover, the Bengaluru-based startup behind BharatGPT, India’s pioneering conversational AI model. While the investment amount has not been disclosed, the development marks a turning point in the relationship between traditional financial institutions and next-generation AI companies.

By backing CoRover, HDFC Bank is not only adopting cutting-edge technology but also showing confidence in India’s ability to develop AI models capable of competing globally. The partnership aims to bring more personalized, multilingual, and intelligent customer experiences into India’s banking sector.

CoRover and BharatGPT: A Homegrown AI Success Story

Founded in 2016, CoRover has long been at the forefront of conversational AI solutions, providing chatbots and virtual assistants for enterprises, government bodies, and large-scale consumer platforms. Its flagship creation, BharatGPT, is India’s first indigenous large language model (LLM), designed to support over 12 Indian languages and 100+ dialects.

Unlike generic AI models, BharatGPT has been optimized for local contexts, cultural nuances, and vernacular comprehension, making it a crucial tool for financial inclusion in a multilingual nation. The model is already being used in sectors such as e-governance, travel, and telecom. With HDFC Bank’s investment, BharatGPT is set to enter mainstream banking.

Why HDFC Bank is Betting on Generative AI

For HDFC Bank, India’s largest private-sector lender, the generative AI banking investment is part of a broader digital transformation strategy. Banking has historically been slow to adopt disruptive technologies, but AI is changing that narrative.

Key Use Cases Anticipated:

- Customer Service Automation – BharatGPT-powered chatbots can answer routine queries in multiple languages, reducing wait times and call center loads.

- Fraud Detection & Risk Management – AI-driven anomaly detection can strengthen security.

- Loan Processing & KYC – AI can help streamline loan applications and document verification.

- Personalized Banking – Customers may receive financial advice tailored to their spending habits.

By tapping into CoRover’s expertise, HDFC aims to stay competitive against digital-first banks and fintechs that are already harnessing generative AI for rapid scaling.

Industry Reactions

The news has generated strong reactions from both banking and AI circles.

- Fintech Analysts: “HDFC’s generative AI banking investment could set a precedent for other Indian banks. CoRover’s BharatGPT has the unique advantage of localization, which global models like GPT-5 cannot easily replicate.”

- AI Researchers: Many believe that HDFC’s trust in BharatGPT is validation of India’s LLM ecosystem, which has been overshadowed by U.S. and Chinese players.

- Investors: The move signals that AI is no longer just a cost-saving tool but a value-creation driver for traditional institutions.

The Broader Trend: AI in Indian Banking

The Indian banking sector has increasingly turned to automation, with chatbots already deployed in limited capacities. But this is the first time a homegrown LLM has received direct banking investment. Competitors like ICICI and SBI are likely watching closely.

Globally, JPMorgan, Goldman Sachs, and HSBC have all been experimenting with generative AI, but few have invested directly in AI startups. HDFC’s step makes it a pioneer in Asia.

Future Outlook

The coming months will be crucial. Insiders suggest that pilot projects are already being designed where BharatGPT will handle customer inquiries across loan, credit card, and rural banking divisions. If successful, the deployment could extend nationwide.

There are also possibilities of integrating BharatGPT with voice-based banking, enabling rural customers with low literacy levels to access banking services easily.

Conclusion

HDFC Bank’s investment in CoRover is not just a financial deal—it is a strategic bet on the future of AI in finance. The generative AI banking investment bridges the gap between traditional banking and modern technology, opening the door for more inclusive, efficient, and intelligent financial services across India.

As BharatGPT finds its way into HDFC’s ecosystem, millions of customers may soon find themselves speaking directly to a homegrown AI banker.

One Comment