Introduction

Between July 17 and July 25, 2025, Galaxy Digital conducted a staggering $9 billion Bitcoin sale on behalf of an early investor—liquidating approximately 80,000 BTC—with surprisingly minimal effect on the broader market. This well-orchestrated transaction underscores a significant evolution in crypto infrastructure and institutional behavior, showcasing resilience in the face of large-scale asset unloading. The focus keyword, Galaxy Digital Bitcoin sale, reflects this market-defining event.

Background: Galaxy Digital and Institutional Crypto

Galaxy Digital, founded by Michael Novogratz, has emerged as a leading institutional liquidity provider. Historically, mega sales like Mt. Gox’s unwinding or FTX-era liquidations triggered dramatic price crashes. This time, despite the magnitude, the market absorbed the sale with little disruption. Analysts attribute this calm to improved over-the-counter (OTC) infrastructure, deeper liquidity pools, and greater institutional participation.

Execution of the Sale

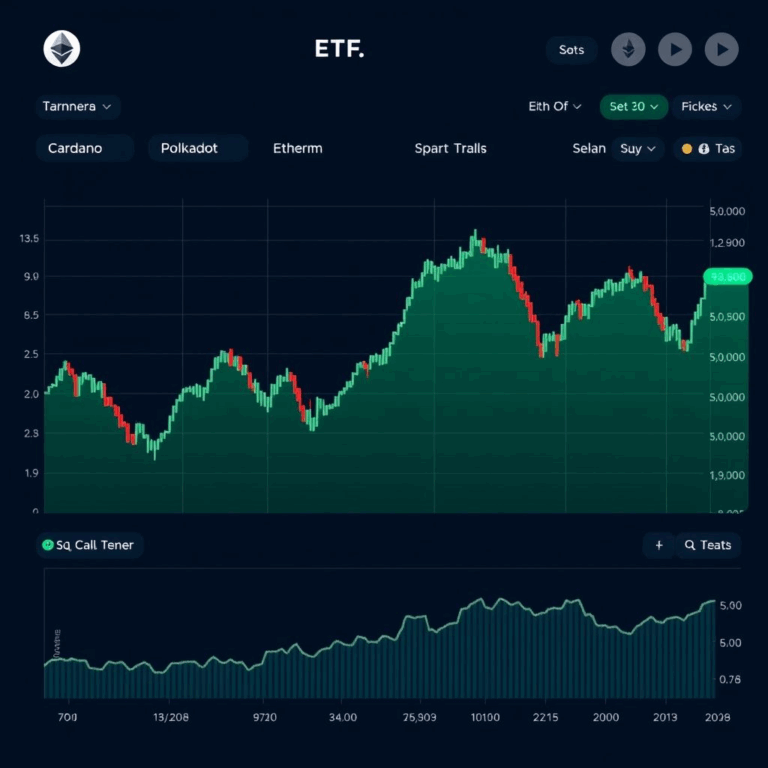

The sale, executed over multiple days and carefully structured via OTC desks and block trades, barely nudged Bitcoin’s price. It dipped momentarily to around $116,000 before rebounding above $119,000. Industry insiders praised the precision of execution, noting it as one of the most well-managed exits in crypto history

Market Response

Bitcoin’s sideways price movement reflects growing market maturity. Traders interpreted the muted reaction as a sign that supply pressure is decreasing amid rising institutional demand. This also contrasted sharply with earlier crypto cycles, where liquidity shocks often triggered cascading selloffs.

Expert Reactions

Senior market strategists commented: “This sale proceeding with barely a hiccup marks an institutional-grade maturation of crypto markets.” Another analyst observed that robust custody infrastructure and deeper OTC channels allowed this liquidation without shaking market confidence.

Broader Impacts

- Demonstrated liquidity maturity: Markets can now absorb massive transactions without volatility.

- Confidence boost: Institutional players gain faith in crypto’s capacity to handle large flows.

- Signal of incumbent exit readiness: Long-held Bitcoin by early investors can be monetized without triggering price collapse.

Future Outlook

As more early adopters potentially choose to exit or rebalance portfolios, professional execution mechanisms will remain essential. This event sets a new standard for large-scale digital asset transactions and may encourage more conservative reserve management by institutional holders.

Conclusion

The Galaxy Digital Bitcoin sale has become a central narrative in crypto’s institutional maturity. When an $9 billion sell-off passes with little turmoil, it speaks volumes about market evolution—and points toward a stable, long-term future.