Introduction

The financial services industry has long grappled with an uncomfortable paradox: advisers tasked with guiding clients through modern investment landscapes often rely on outdated, inefficient software systems designed decades ago. On September 9, 2025, Marloo, an AI startup headquartered in London and Auckland, announced that it raised $2.7 million in pre-seed funding to change that narrative. The round was led by Blackbird Ventures with participation from fintech veterans including Revolut’s Chief Legal Officer and Adyen’s former COO.

This Marloo AI funding is more than just another injection of capital into a promising startup; it represents a decisive push toward modernization in a sector where advisers remain shackled by legacy systems.

The Problem with ’90s Software in 2025

Financial advisers in the UK and other mature economies rely heavily on tools that date back more than two decades. Many of these platforms were designed for static, paper-heavy environments. They fail to support real-time collaboration, are weak in automation, and lack AI capabilities.

This forces advisers to juggle multiple platforms, spend hours on administrative work, and sometimes make costly mistakes when consolidating data across fragmented systems. According to industry surveys, advisers spend up to 40% of their week on paperwork and manual record-keeping—time that could be better spent engaging with clients.

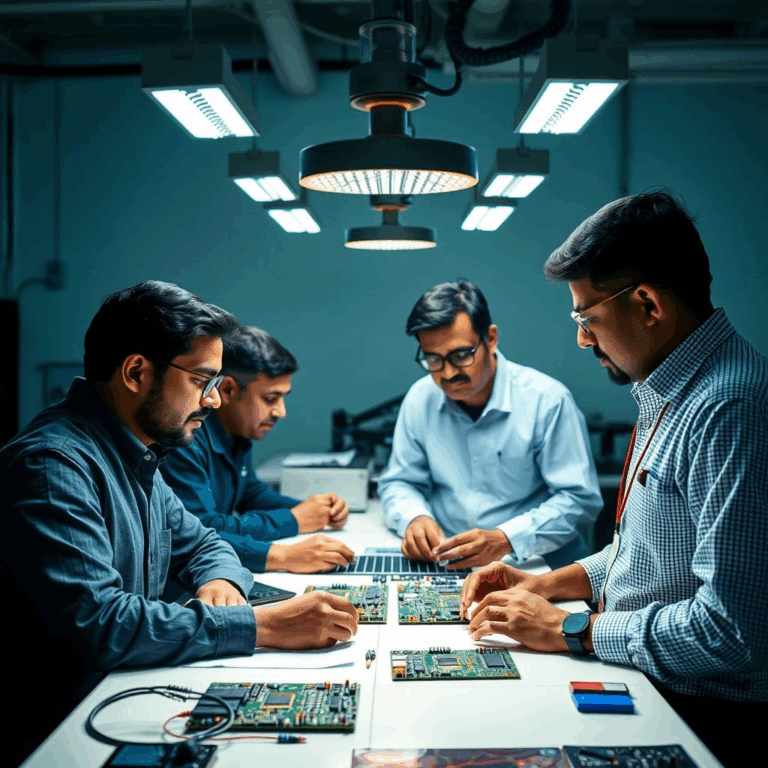

Marloo’s founders recognized this gap: advisers deserve intuitive, AI-powered tools that reduce drudgery while enhancing compliance and client relationships.

What Marloo Offers

Marloo positions itself as a workflow automation assistant for financial advisers. At its core is an AI-driven platform designed to manage three key pain points:

- Automated Note-Taking:

The AI records client meetings, transcribes discussions, and generates structured notes—reducing human error and saving hours of manual typing. - Document Generation & Compliance:

Whether it’s investment reports, risk disclosures, or follow-up letters, Marloo automatically drafts tailored documents, ensuring they are aligned with regulatory requirements. - Client Communication:

The “Ask Marloo” tool allows advisers to instantly query past interactions, providing context-aware responses when drafting emails or engaging with clients.

Combined, these features create a knowledge hub where advisers and their teams can securely collaborate, share insights, and retrieve records on demand.

Investor Confidence and Comparisons

The participation of Blackbird Ventures, a prominent backer of global startups, adds credibility. Samantha Wong, General Partner at Blackbird, praised Marloo’s obsession with product quality and compared its early trajectory to Canva—another company that transformed a clunky, outdated workflow (graphic design) into a simple, global-first solution.

Other angel investors in the round come with deep fintech expertise, suggesting confidence in Marloo’s ability to solve a universal problem rather than a niche challenge.

The Market Opportunity

The UK financial advice industry manages trillions in assets under advisement, yet much of its infrastructure has stagnated. With regulators tightening compliance requirements and clients demanding digital-first services, advisers are caught in the middle.

Marloo’s solution comes at a pivotal moment:

- Digital Adoption: Post-pandemic, both advisers and clients are comfortable with digital-first communication.

- Regulatory Complexity: Automated compliance can reduce fines and legal risks.

- Global Applicability: Although starting in the UK and Australasia, the problem is global—advisers in the U.S., Canada, and Asia face similar hurdles.

Expert Opinions

Fintech analysts see promise in Marloo’s approach. According to London-based fintech consultant Helena Andrews, “If Marloo delivers a frictionless experience for advisers while maintaining compliance rigor, it could do for financial planning what Slack did for workplace communication.”

Meanwhile, early adopter advisers have reported reclaiming 10–15 hours per week thanks to automation—an efficiency gain that directly translates into more client meetings and improved revenue.

Growth and Expansion Strategy

Currently experiencing 45% month-on-month growth, Marloo plans to use its new funding to:

- Hire AI engineers and compliance experts.

- Enhance multilingual capabilities.

- Expand its footprint across UK, Australia, and New Zealand.

- Pursue partnerships with wealth management platforms.

A North American expansion is already on the horizon, as regulatory environments there increasingly favor tech-driven compliance monitoring.

The Competitive Landscape

While startups like Cognicor and Finmate also serve financial advisers with AI tools, Marloo differentiates itself through user experience. Instead of overwhelming advisers with dashboards and jargon, it aims to provide an “invisible AI assistant” that blends seamlessly into daily workflows.

This focus on design and usability may prove decisive. As Blackbird’s Wong put it: “Marloo doesn’t just automate tasks; it makes advisers enjoy the process again.”

Future Outlook

With AI increasingly integrated into regulated industries, Marloo’s biggest challenge will be balancing automation with strict oversight. Success will depend on building trust—not only among advisers but also with regulators who scrutinize every financial communication.

If Marloo succeeds, the startup could become a household name in adviser circles within the next 3–5 years, potentially setting the stage for a major acquisition or IPO.