Introduction

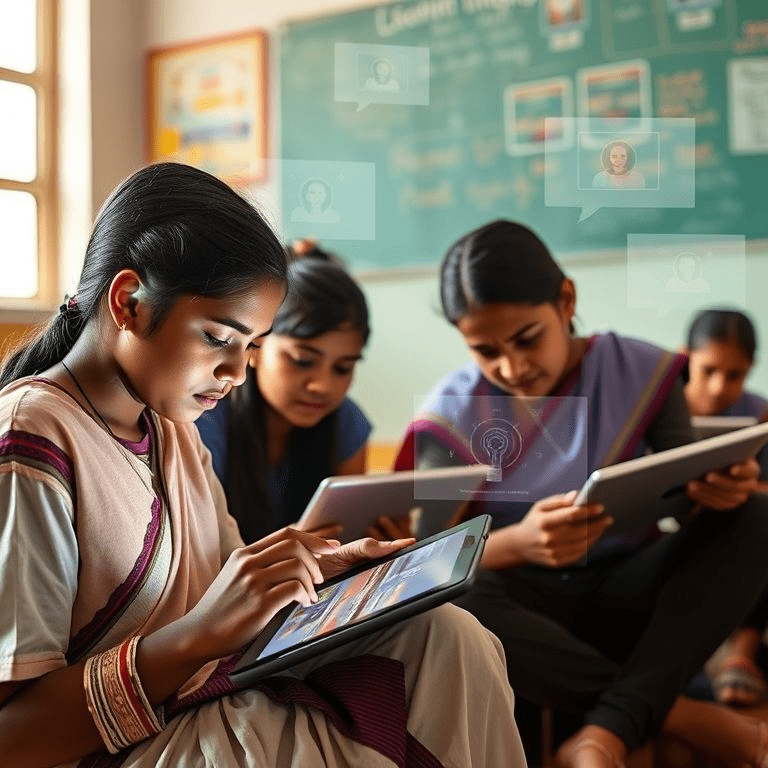

India’s education technology (edtech) sector has begun a striking recovery in the first half of 2025. According to recent reports, edtech funding in India increased by more than five times year-over-year (YoY). The primary drivers of this resurgence are investor enthusiasm for artificial intelligence (AI)-powered learning solutions, platforms offering vernacular content, and firms focussing on workforce upskilling and study-abroad facilitation.

This surge signals renewed confidence after a period of stagnation, regulatory scrutiny, and shifting business models in the sector.

Background: The Lull and the Turning Point

In the years prior to 2025, India’s edtech domain saw both boom and bust. During the COVID‐19 pandemic, remote learning, virtual classrooms, and online content platforms saw enormous growth. But post-pandemic, with schools reopening and demand normalizing, several startups faced challenges:

- Unit economics: High customer acquisition costs (CAC), retention challenges, and limited differentiated offerings led to unsustainable burn rates for many.

- Regulatory and quality concerns: As content scaled, criticisms of low quality content, inflated claims, or lack of local alignment became more visible.

- Investor caution: With big edtech valuations in earlier years, some investors pulled back, preferring more mature or diversified business models.

Into this environment, the first half of 2025 arrives as a turning point. Investors are now redirecting capital toward edtech businesses that embed AI, local language content, and workplace or global exposure skills. The Economic Times+1

What Happened: Key Trends in H1 2025

Growth Metrics & Areas of Investment

- The year-on-year growth in funding is over 5×. While exact funding totals differ by source, there is consensus that AI, vernacular education, upskilling, and study-abroad platforms have attracted much of the new capital.

- AI is being applied not just in generic content delivery, but in adaptive learning, personalized assessment, auto-grading, and chatbots for student support. Platforms doing this are getting preferential attention.

- Vernacular learning is rising: instruction and content in regional Indian languages. This helps in reaching students in semi-urban and rural areas who may not prefer or have facility with English-first platforms.

- Upskilling platforms (i.e. those that help working professionals, certifications, short-term digital skills) saw increased investments. Study abroad or test-prep services aimed at global exposure also contributed.

Notable Examples

- While many smaller rounds are happening, the trend is that investors are more selective: looking for product-market fit, measurable outcomes, and scalability.

- Some platforms in vernacular content or hybrid learning models (offline + online) are scaling, both in users and revenue. Specific names aren’t always disclosed in aggregated data, but the structure of investment indicates a shift.

Reactions: What Founders, Investors Are Saying

While public quotations are fewer, the prevailing sentiment in interviews and media analysis is that edtech startups that survived the 2022–24 period by refining their business models are now reaping benefits.

One investor comment from media (paraphrased) is:

“AI has allowed us to personalize at scale, but vernacular content gives us reach into markets previously underserved.”

Founders also note that customers (students, parents) are now more value sensitive, expecting outcomes (better scores, verified credentials, upskilling) rather than just content volume. Markets beyond the big metros (tier II/III India) are increasingly important.

Impact: What This Means for the Edtech Ecosystem

- Geographic expansion: More startups will expand into non-metro and rural areas, leveraging regional language content and perhaps leveraging hybrid offline-online models.

- Product innovation: AI tools for assessment, adaptive learning, content creation, and personalization will see faster development. Startups that can show measurable learning outcomes will have a competitive edge.

- Regulatory attention: With renewed investment, regulators will likely focus more on content quality, standardization, certifications, and student safety. Policies around recognition of online credentials may be scrutinized.

- Margin pressure and sustainability: Although funding is increasing sharply, profitability remains a key challenge. CAC and retention issues must be addressed. Investors will favor scalable models.

Challenges Ahead

- Digital divide: Even with vernacular content and AI, many students lack reliable internet connectivity or devices, especially in remote areas. Without addressing infrastructure, the reach will be limited.

- Quality of content and pedagogy: Mass production of content risks lowering pedagogic value. Maintaining content efficacy in multiple regional languages is resource intensive.

- Talent for AI & EdTech: There is demand for content creators, AI specialists, adaptive learning design experts, and localization experts (language, cultural context). The supply may lag.

- Regulatory uncertainty: Rules for online credentials, cross-border education, data privacy for students, content moderation – all may face scrutiny.

Future Outlook

In the next 12-18 months:

- Expect more funding rounds targeting startups that combine AI + vernacular + measurable outcomes.

- Possible mergers or acquisitions among smaller players, especially in vernacular segments, to consolidate content production, reach, and localization.

- Growth of hybrid learning models: offline centers + digital content, particularly for test preparation and skill certifications.

Over longer term (2-3 years):

- Edtech in India may begin to be seen not just as service platforms but as credentialing networks (recognized certificates, partnerships with universities, employers).

- Potential for export: platforms replicable in South Asia, Southeast Asia, Africa – places with similar language, socio-economic and educational challenges.

- Potential IPOs: as edtech firms mature and show consistent revenues, some may aim for listing or large capital injections.