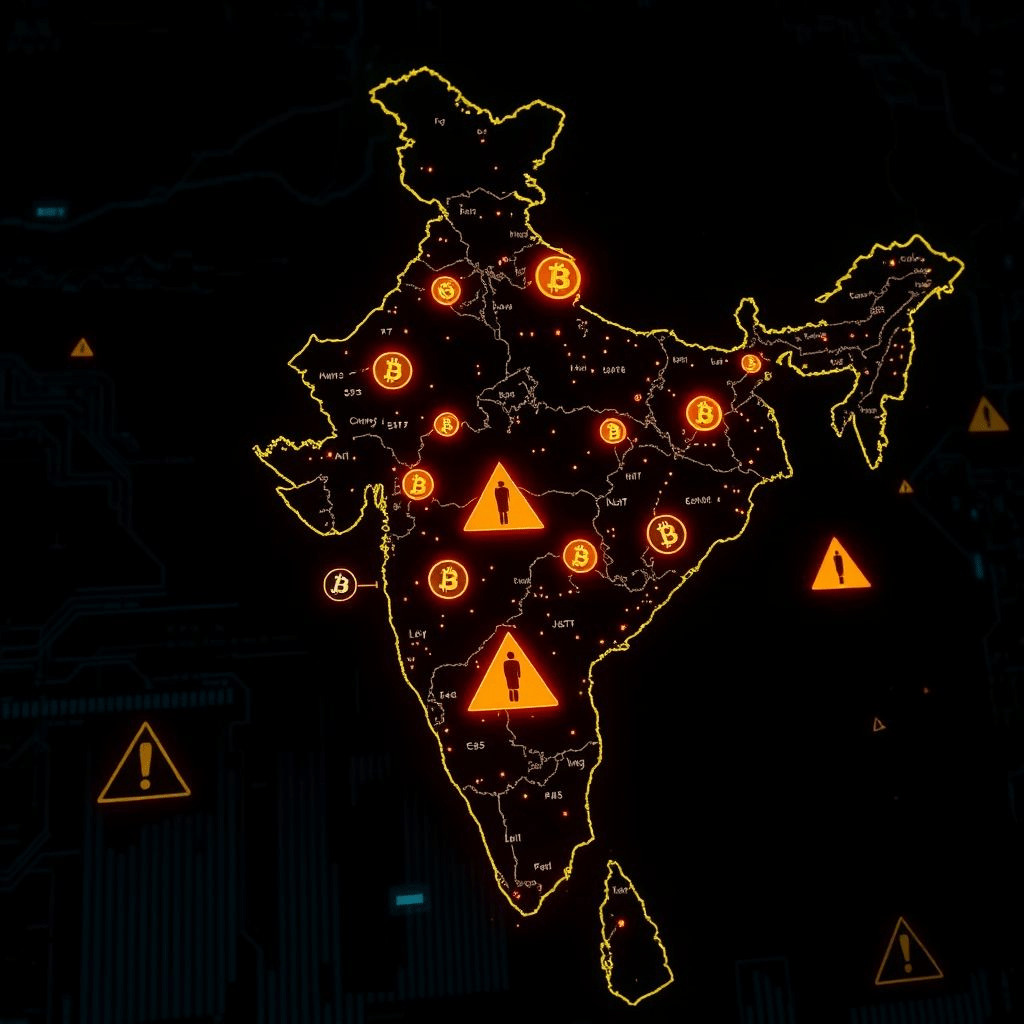

Introduction: A new frontier in cybercrime

India’s digital economy is expanding at breakneck speed—but with opportunity comes risk. In a shocking revelation this week, cybersecurity experts disclosed that more than 90% of cybercrimes in India have now shifted to cryptocurrency platforms. This trend, referred to as a crypto cybercrime shift, has sparked alarm among policymakers, law enforcement, and tech specialists who see the growing dominance of digital assets as a double-edged sword.

The announcement was made at a seminar organized at the Uttar Pradesh State Institute of Forensic Science (UPSIFS), where senior police officers, cybersecurity analysts, and legal experts gathered to address India’s rapidly evolving cybercrime landscape.

Background: India’s rise in digital finance and crypto adoption

India is one of the fastest-growing cryptocurrency markets in the world. According to recent reports, more than 115 million Indians own or trade cryptocurrencies, making the country the largest crypto user base globally. This rapid adoption, driven by young investors, remittances, and the search for alternative assets, has outpaced regulatory frameworks.

Unfortunately, cybercriminals have seized this opportunity. With blockchain’s anonymity, global reach, and irreversible transactions, it has become the perfect tool for fraud, ransomware, money laundering, and financial scams.

DIG Cyber Cell Pawan Kumar, who spoke at the UPSIFS seminar, warned:

“The challenge is no longer just hackers stealing data. We are now dealing with highly organized syndicates leveraging cryptocurrency to fund illicit networks. The anonymity of blockchain makes detection and prosecution extremely difficult.”

What happened: 90% cybercrime shift into crypto platforms

The seminar’s biggest revelation was the data presented by officials: nine out of ten cybercrimes investigated in the past year involved cryptocurrency platforms either directly or indirectly.

Some of the most common crypto-linked crimes include:

- Investment scams: Fraudsters promising high returns through fake exchanges or Ponzi schemes.

- Ransomware attacks: Hackers encrypting corporate or government data and demanding crypto payments.

- Dark web transactions: Illegal sales of drugs, weapons, and stolen data funded via Bitcoin or Monero.

- Cross-border laundering: Syndicates moving illicit funds through crypto mixers and offshore exchanges.

A police spokesperson noted that while cyber frauds like phishing and identity theft continue, the vast majority now involve a crypto element, whether as a payment medium, laundering channel, or cover for illicit activity.

Why criminals prefer crypto: anonymity and global reach

The crypto cybercrime shift can be explained by four key factors:

- Pseudonymity of blockchain – Criminals can transact without revealing real-world identities.

- Lack of regulation – Many countries, including India, are still drafting comprehensive crypto laws.

- Global liquidity – Crypto allows instant transfer of funds across borders, bypassing banking oversight.

- Technological complexity – For law enforcement, tracing crypto requires advanced blockchain forensics, which are expensive and resource-heavy.

Reactions: Government and expert commentary

The Indian government has been vocal about the risks. The Reserve Bank of India (RBI) has previously flagged cryptocurrencies as a threat to financial stability. Meanwhile, the Ministry of Home Affairs has been investing in blockchain forensic tools to aid cybercrime units.

Cybersecurity analyst Rohan Mehta commented:

“This isn’t just an Indian issue. Globally, criminals are ahead of regulators. The U.S., EU, and India must collaborate on real-time crypto intelligence sharing. Otherwise, the gap between criminals and enforcement will widen.”

Impact: India’s digital security under threat

The rise of crypto-related crime has serious implications:

- For individuals – Scams targeting first-time investors have wiped out life savings.

- For businesses – Ransomware attacks have disrupted operations in healthcare, finance, and manufacturing.

- For national security – Officials warn that terror financing and cross-border money laundering increasingly use cryptocurrencies.

If unchecked, this crypto cybercrime shift could undermine confidence in India’s digital economy, slowing adoption of blockchain-based innovations like CBDCs (Central Bank Digital Currencies).

Solutions: AI, quantum tech, and global coordination

Experts at UPSIFS proposed several solutions:

- AI-driven monitoring – Using artificial intelligence to detect unusual blockchain activity in real-time.

- Quantum cryptography – Exploring quantum-resistant solutions to secure financial systems.

- KYC enforcement – Stronger identity verification for crypto exchange users.

- Global treaties – International data-sharing agreements to track criminals across jurisdictions.

- Public awareness – Campaigns teaching citizens to identify scams and secure digital wallets.

Future outlook: Regulation is coming

India has yet to finalize a comprehensive cryptocurrency law. While taxation policies exist (30% on crypto gains), there is no dedicated regulatory framework for investor protection or anti-money laundering.

Analysts expect that the crypto cybercrime shift revelations will accelerate legislative action. Already, discussions are underway to mandate exchange licensing, blockchain monitoring, and coordinated action between the RBI, SEBI, and law enforcement.

Conclusion: A wake-up call for India’s digital future

The seminar’s revelations are a wake-up call. The crypto cybercrime shift is no longer theoretical—it’s a reality shaping India’s cyber landscape. If regulators, businesses, and citizens don’t adapt quickly, the cost may be immense, both financially and socially.

As India pushes forward with its digital economy ambitions, balancing innovation with security will be the country’s greatest challenge.