Background: The Rise of AI Data Labeling

Artificial intelligence relies on high-quality labeled datasets. Traditionally, data annotation has been labor-intensive, involving low-cost labor in developing economies. As AI applications burgeon—from autonomous vehicles to medical diagnostics—the demand for reliable, fast, and scalable labeling solutions has soared.

Founded in 2023, Micro1 emerged with a novel model: combining AI‑enhanced workflows with skilled expert annotators, rather than crowdsourced low-cost labor. The startup’s approach emphasizes accuracy, compliance, and domain-specific experience, making it particularly appealing to regulated industries like healthcare, finance, and autonomous driving.

In a few short months, Micro1 scaled from $10 million to $50 million in annualized revenue, and projected to surpass $100 million by September 2025

Funding Round Details: A High-Speed Series A

On July 28, 2025, reports confirmed that Micro1 is finalizing a Series A funding round that values the company at approximately $500 million. The round is led by 01A and LG Technology Ventures, with additional participation from former Twitter COO Adam Bain, who recently joined Micro1’s board. The speed and size of the round underscore investor confidence in the startup’s dual-strength model—AI plus expert annotators .

According to sources, Micro1’s rapid growth and its poaching of clients formerly served by Scale AI (after Scale’s CEO moved to Meta) accelerated the investor interest. Major clients such as Google and OpenAI who sought alternatives are reportedly transitioning workloads to Micro1 due to concerns over data exposure to Meta’s new superintelligence labs .

Why Micro1 Stood Out

- Domain-Specific Accuracy: Micro1 employs specialized annotators (e.g., radiologists, legal experts), yielding high precision essential in regulated contexts.

- AI-Enhanced Hybrid Workflow: Proprietary AI tools accelerate annotation while expert reviewers ensure quality, achieving both scale and accuracy.

- Rapid Revenue Growth: From $10M to $50M ARR in mere months, projecting $100M by September 2025 signals strong market product‑fit.

- Trust and Compliance: Its model aligns with enterprise and regulatory requirements, making it ideal for healthcare, finance, and autonomous systems.

Founder & Investor Commentary

While specific founder quotes haven’t surfaced yet, investor insights shed light on the rationale:

- Adam Bain, now on Micro1’s board, is said to appreciate the company’s ability to attract and scale with enterprise clients previously dependent on Scale AI.

- Ravi Kapoor (equivalent investor at LG Technology Ventures) was reported to praise Micro1’s compliance focus and its ability to win large contracts quickly.

Clients reportedly value Micro1’s transparency and separate-data-handling, especially in a moment when Scale AI customers are actively seeking alternatives due to leadership shifts and data governance concerns.

Impact on Industry and Competitors

Micro1’s rise poses a direct challenge to Scale AI, long a leader in the data labeling space. After Scale’s CEO departure, Micro1 gained traction with technical-rich clients wary of political or contract exposure.

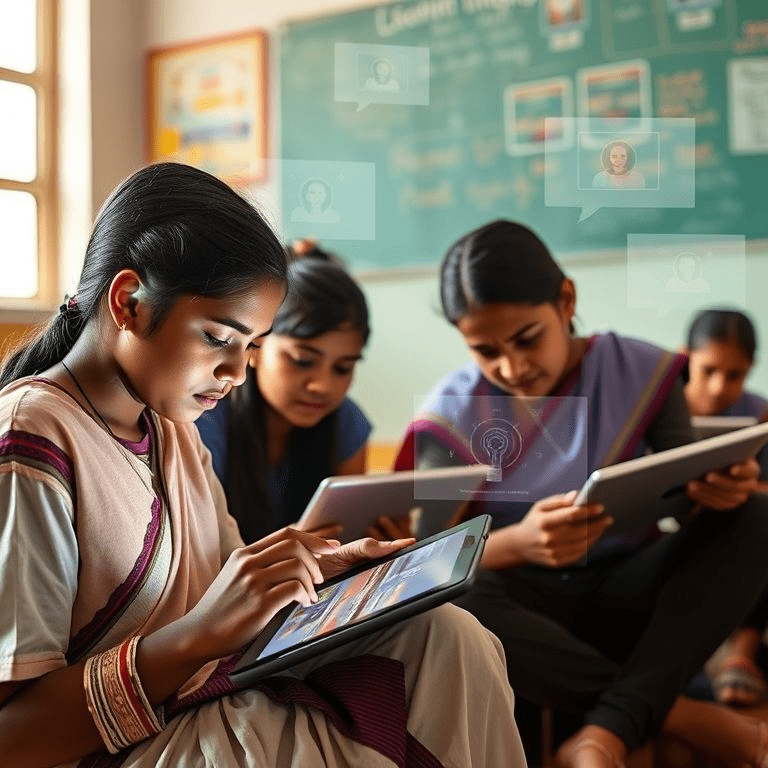

The broader data-labeling market is now evolving—more enterprises demand higher standards: traceable human oversight, guarantee of reviewer quality, and specialized domain knowledge. Micro1 leads this shift, accelerating the premiumization of data labeling services.

Industry analysts note that Micro1’s trajectory may influence pricing dynamics in the sector, with higher-cost, higher-trust services now commanding enterprise premium; the lower-cost, crowdsourced model may cede ground in sensitive verticals.

Challenges & Risks Ahead

- Scaling Experts: Maintaining domain-level annotator quality while scaling is operationally intense and potentially costly.

- Competition: Other startups like Surge AI and legacy players may pivot to premium offerings.

- Profit Margins vs Growth: Balancing high-quality, expert labor costs with investor expectations on unit economics will be key to sustainable margins.

Still, Micro1’s early results—client endorsements, revenue growth, and valuation—suggest strong alignment of mission and capability.

Future Outlook: Where Micro1 Heads Next

In the coming 6–12 months, Micro1 is expected to:

- Expand into enterprise verticals such as medical imaging labeling, autonomous systems, and financial compliance datasets.

- Bolster automation tooling, reducing human workload and increasing throughput.

- Explore strategic partnerships or acquisitions, especially in AI platform ecosystems.

- Push for expansion in North America, Europe, and select APAC markets to diversify demand.

If projections hold, Micro1 could reach $200M+ ARR by mid‑2026, solidifying its place as an industry-standard AI labeling provider.