The cryptocurrency market experienced a dramatic surge this week, with Bitcoin at the forefront, driven by speculation surrounding the approval of Bitcoin exchange-traded funds (ETFs). As institutional investors show increasing interest, the ripple effects are felt across the crypto ecosystem.

The Bitcoin ETF Buzz

This week, financial giants such as BlackRock and Fidelity submitted applications for Bitcoin ETFs. Experts predict these funds could open floodgates for institutional capital into the cryptocurrency market, boosting liquidity and market stability.

Impact on Market Sentiment

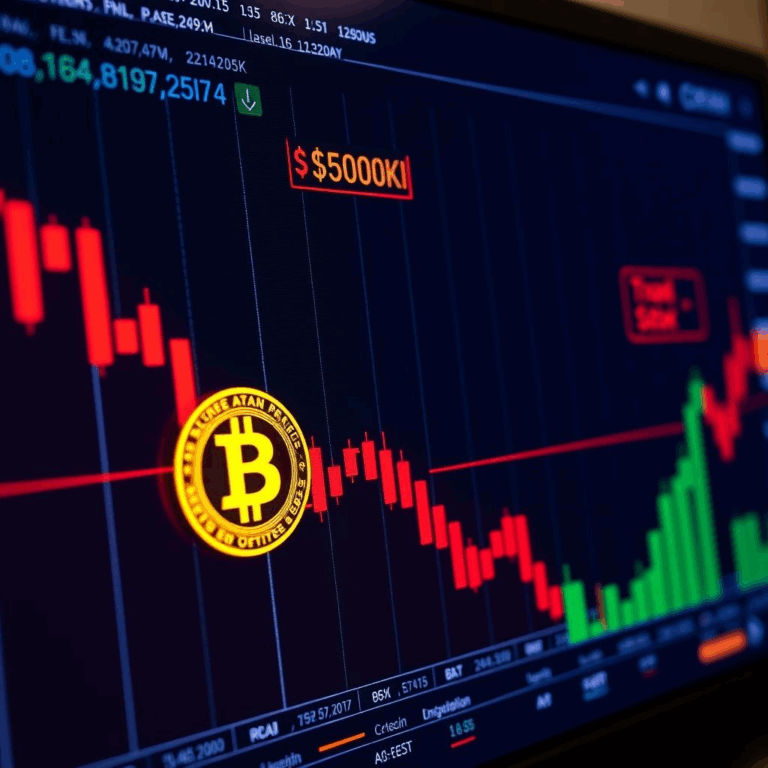

Bitcoin prices soared by 15% in 48 hours, breaking past the $30,000 mark. Other cryptocurrencies, including Ethereum and Solana, followed suit, indicating a renewed bullish sentiment across the board.

Challenges Ahead

Despite the optimism, regulatory hurdles remain. The U.S. Securities and Exchange Commission (SEC) has expressed concerns over market manipulation and investor protection. Industry leaders believe resolving these issues could define the future trajectory of Bitcoin ETFs.

Expert Opinion

“Approval of Bitcoin ETFs could be a game-changer, legitimizing cryptocurrencies as a mainstream investment,” says blockchain strategist Elena Ortiz.

Key Takeaway

The growing anticipation around Bitcoin ETFs signals a significant shift in market dynamics, potentially ushering in a new era of institutional adoption.

Image Prompt: A futuristic stock exchange floor with holographic Bitcoin symbols and ETF charts displayed in the background.

Tags: Bitcoin ETF Speculations, cryptocurrency market, Bitcoin news, institutional adoption, blockchain trends

Keywords: Bitcoin ETF Speculations, Bitcoin price surge, cryptocurrency trends, institutional crypto investment, crypto market updates

Image Alt Text: Bitcoin symbols displayed on a futuristic stock exchange.

Image Caption: Bitcoin’s rally ignited by ETF speculations reshapes the market landscape.

Image Description: A vibrant depiction of a modern stock exchange showcasing Bitcoin’s integration with ETFs, symbolizing market optimism.

Image Title: Bitcoin ETF Market Surge

Short URL Slug: bitcoin-etf-speculations

2. Ethereum Upgrade: The Shanghai Hard Fork and Its Long-Term Impact

Focused Keyword: Ethereum Shanghai Hard Fork

Description:

The Ethereum Shanghai Hard Fork, executed earlier this week, marks a critical milestone in the blockchain’s journey toward scalability and sustainability. This upgrade introduces major changes to network operations and staking.

Core Features of the Upgrade

- Staking Withdrawal: Enables validators to withdraw staked Ethereum, increasing flexibility for network participants.

- Gas Optimization: Reduces transaction costs, enhancing usability.

- Layer 2 Integration: Improves compatibility with second-layer scaling solutions.

Market Reactions

The Ethereum price experienced a modest 7% increase following the upgrade, with analysts pointing to its potential for long-term growth. Layer 2 projects like Polygon and Arbitrum have also seen renewed interest.

Stakeholders’ Perspectives

“Shanghai’s successful implementation proves Ethereum’s resilience and adaptability,” says blockchain developer Hiroshi Tanaka.

Future Implications

The upgrade lays the groundwork for Ethereum’s next phase, known as ‘The Surge,’ which aims to improve scalability for mass adoption.

Key Takeaway

The Shanghai Hard Fork reinforces Ethereum’s position as the leading smart contract platform, emphasizing innovation and adaptability.

Bitcoin ETF Speculations, cryptocurrency market, Bitcoin news, institutional adoption, blockchain trends ,Bitcoin Surge