Introduction

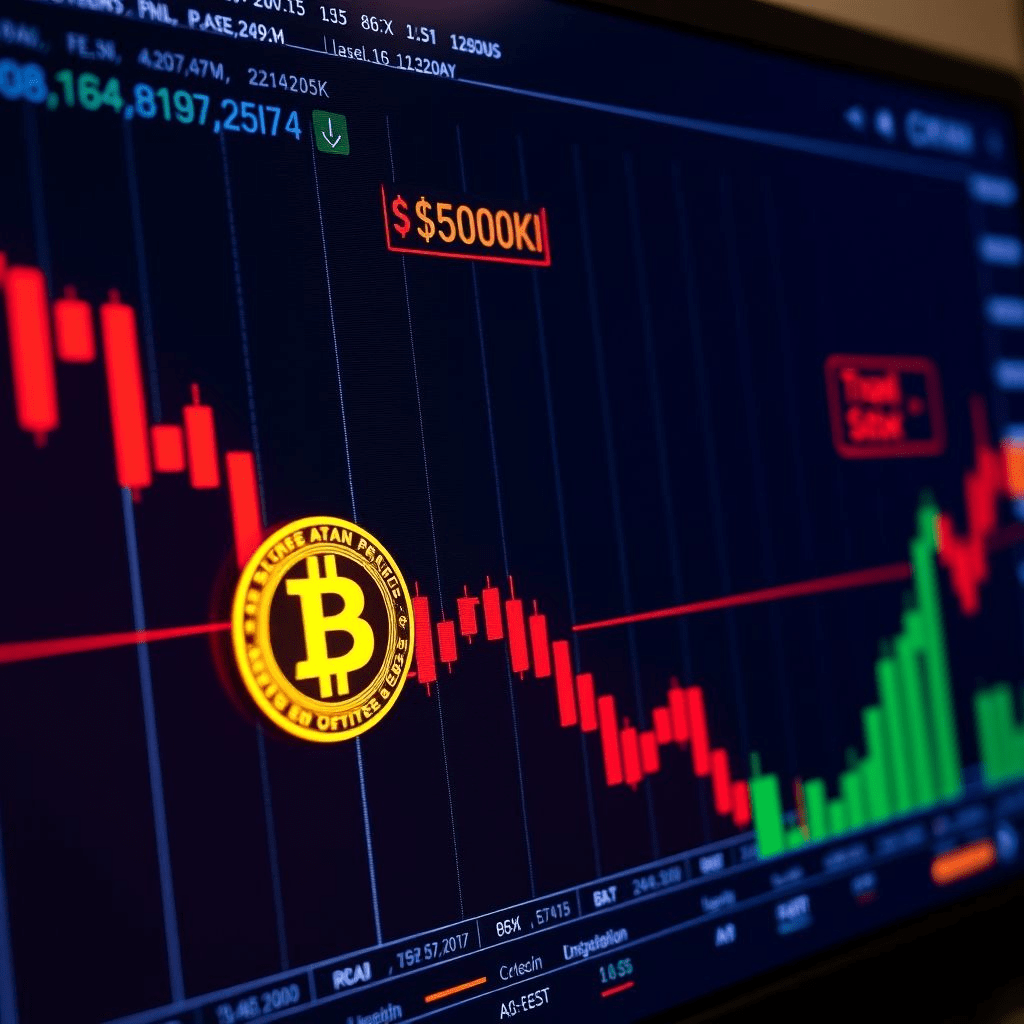

On June 22, Bitcoin experienced a Bitcoin price drop, declining more than 4% to around $99,237—marking the first dip below $100K in several days.

Context and Background

After reaching highs above $106K last week, Bitcoin has come under pressure. The cryptocurrency’s sharp reversal wiped out major market gains, generating renewed volatility after prolonged gains.

What Caused the Fall

Macro factors such as geopolitical tensions, rising Treasury yields, and reactions to U.S.–Iran conflicts contributed. The sell-off was exacerbated by technical triggers as Bitcoin breached key support levels under $100K.

Market Reactions

Traders saw BTC fall from $103K to just under $99K. Ether dropped over 8%, and altcoins like Solana, Cardano, and Dogecoin also recorded sharp losses.

Expert Insight

James Toledano of Unity Wallet observed, “Bitcoin’s sudden drop reflects a tension between long-term bullish sentiment and short-term risk aversion.”

Implications

The Bitcoin price drop triggered approximately $450 million in long-order liquidations across leveraged positions, heightening market volatility and prompting risk reassessment.

Future Outlook

Analysts remain divided—some expect a swift rebound above $100K, while others warn that ongoing geopolitical tensions may fuel further losses to $95K or lower.

Conclusion & Call to Action

The Bitcoin price drop highlights fragility even after robust gains. Investors should employ disciplined risk management, such as setting stop-losses and diversifying crypto portfolios.