Introduction

On June 17-18, London’s fintech Aspora announced $53 million in new funding, co-led by Sequoia and Greylock, boosting total capital to $93 million to date.

Background

Founded in 2022 by Stanford dropout Parth Garg, Aspora enables cross-border financial services aimed at Non-Resident Indians (NRIs). The platform supports seamless transactions, zero-fee remittances in the UAE, competitive FX rates, and an intuitive user experience.

Funding Details

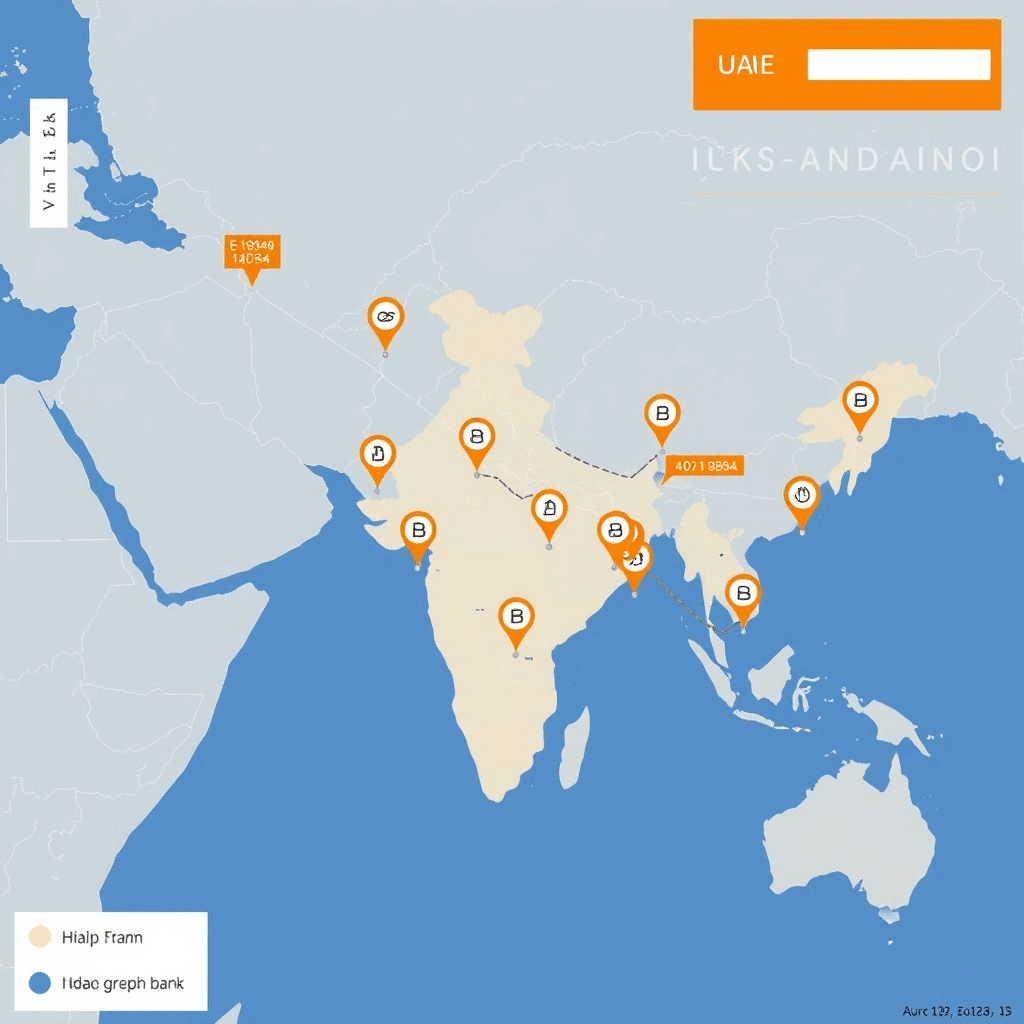

Sequoia and Greylock spearheaded the round, with Quantum Light Ventures also participating. Aspora plans to use funds to expand operations in the U.S. (July 2025), Canada, Australia, and Singapore before year-end.

Performance & Metrics

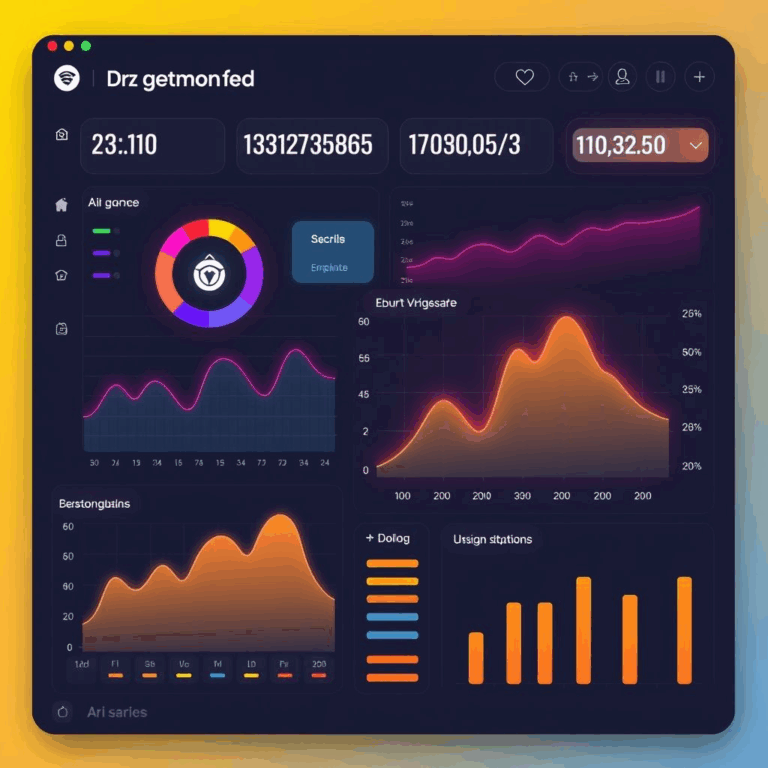

Serving 250,000 users in UAE, Aspora processed over $2 billion in transaction volume—up from $400 million—in just six months. Users collectively saved $15 million in fees.

Founder Commentary

Parth Garg said adoption ramp has exceeded expectations. “NRIs deserve transparent and affordable banking. This round supports global scaling.”

Market Context

With rising NRI remittance (India receives ~$100B annually), fintechs that simplify transfers play strategic roles. Aspora’s zero-fee UAE remittance and transparent FX model position it ahead.

Challenges

Regulatory compliance, multi-currency integrations, and partnerships with local banking networks present ongoing hurdles. Aspora is actively onboarding compliance teams across new regions.

Outlook

The U.S. rollout will introduce U.S.-based banking products. Canada and Australia launches will target diaspora segments. Plans include credit cards and wealth management phases in 2026.

Conclusion & Call to Action

The Aspora funding milestone highlights fintech’s transformative power for diaspora banking. NRIs and fintech watchers should explore Aspora’s rates and upcoming international service expansions.