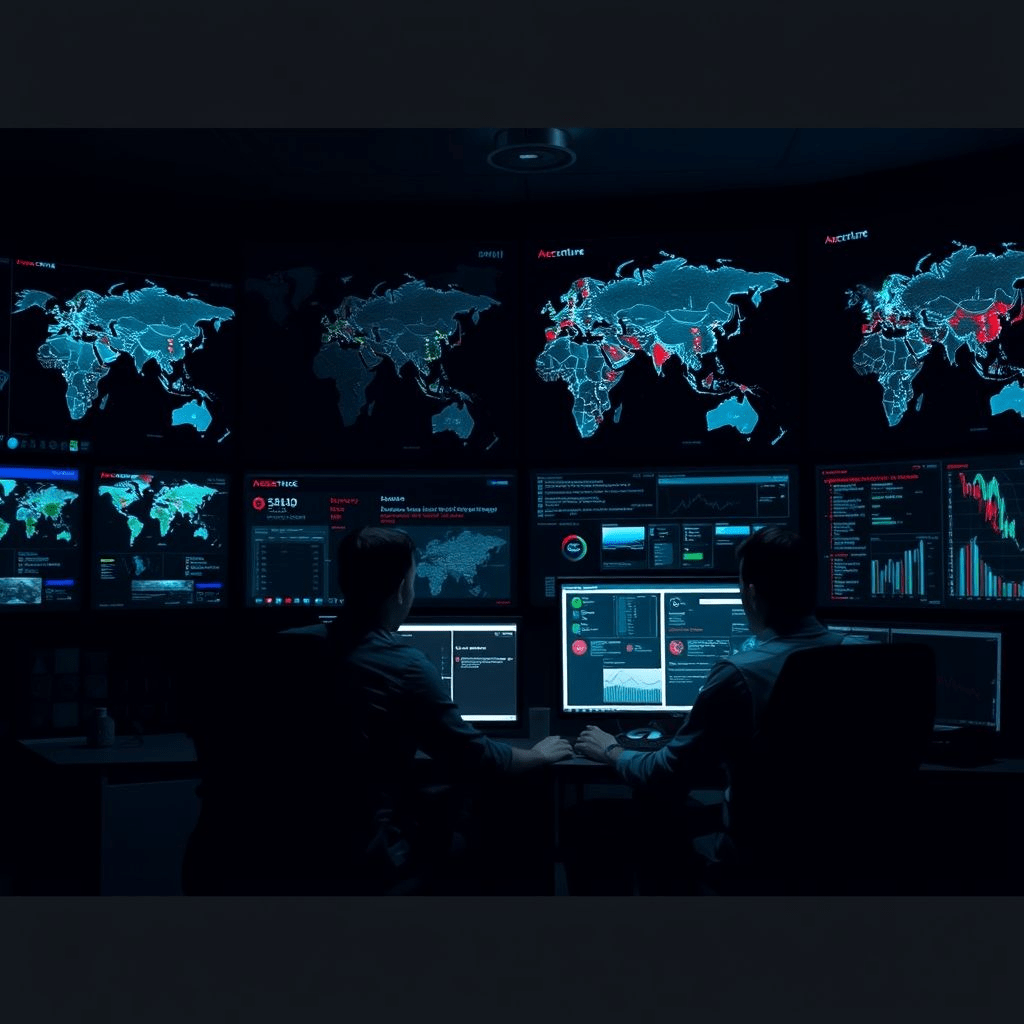

A landmark deal in cybersecurity services

Accenture has agreed to acquire Australia-founded CyberCX in what the company and multiple reports describe as Accenture’s largest-ever cybersecurity acquisition, a move that instantly deepens its managed defense footprint in Australia, New Zealand, and beyond. The transaction, disclosed on August 15, signals a consolidation push as enterprises increase cyber spending amid escalating ransomware, supply-chain attacks, and AI-enhanced threats.

CyberCX, created in 2019 by merging a dozen specialist firms with backing from private equity group BGH Capital, employs roughly 1,400 staff and operates security operations centers across Australia and New Zealand, with additional presence in London and New York. Press and industry reports have pegged the deal value at over A$1 billion, though the companies have not officially disclosed terms.

Why CyberCX matters

Over six years, CyberCX has become a go-to incident response and managed detection and response (MDR) partner across the region, building practices in offensive security, identity and access management, cloud security, and cyber-physical risk. Its partner ecosystem includes major vendors such as Microsoft, Palo Alto Networks, and CrowdStrike. For Accenture, the Accenture CyberCX acquisition adds scale in MDR, threat intelligence, and crisis management while strengthening government and critical-infrastructure credentials in APAC.

In its announcement, CyberCX framed the deal as an opportunity to combine regional expertise with Accenture’s global capabilities and investments in AI-powered security operations. Accenture, for its part, highlighted accelerating client demand as data and digital environments become more connected and adversaries more sophisticated—trends that are stretching internal security teams and making managed services more attractive.

The market context: consolidation and capability stacking

The acquisition continues Accenture’s long-running security build-out; the company has completed around 20 cyber-related acquisitions since 2015. Enterprises are increasingly seeking single partners that can deliver 24/7 monitoring, cross-region incident response, and regulatory-grade reporting—capabilities that smaller boutiques provide well but often cannot scale globally. By integrating CyberCX, Accenture tightens coverage in a geography where threat activity and regulatory obligations have intensified after several headline breaches in Australia and New Zealand over the past three years.

What changes for customers

For CyberCX’s public- and private-sector clients, expect continuity in day-to-day engagements and service-level commitments, with added access to Accenture’s global threat intel, proprietary platforms, and broader transformation services. For multinational customers already working with Accenture, the Accenture CyberCX acquisition offers more boots-on-the-ground in APAC, plus deeper expertise in local compliance, sovereignty requirements, and critical-infrastructure standards.

Accenture has emphasized “secure enterprise reinvention,” positioning cybersecurity as a foundation for AI adoption, cloud migration, and operational technology digitization. That message lands in a region where boardrooms are asking not just “Are we protected?” but “Can we scale securely with AI and cloud without paralyzing risk?”

Expert and market reactions

Early industry reaction points to two takeaways. First, private equity’s exit from CyberCX (BGH Capital) underscores continued investor appetite for realized value in mature cyber assets. Second, global integrators are likely to keep shopping for niche capabilities—particularly incident response talent, identity expertise, OT security, and sovereign cloud know-how. Trade coverage also notes CyberCX’s breadth of certifications (reportedly 2,600+) and relationships with hyperscalers, which should integrate smoothly with Accenture’s alliances.

Impact and risks

While customers may welcome broader service catalogs, integration risks remain: harmonizing tooling, retaining key practitioners, and aligning methodologies across red/blue teams and advisory units. In managed security, talent retention is as critical as technology. Success for the Accenture CyberCX acquisition will rest on keeping senior incident responders, preserving high-trust customer relationships, and ensuring that any platform consolidation enhances—not disrupts—detection quality and response times.

Another factor is regional sovereignty: APAC clients—especially in government, healthcare, and critical infrastructure—often require data residency and specific certifications. Accenture will need to maintain CyberCX’s local assurances while plugging into global platforms. Done right, the combined entity can set a high bar for regulated-industry MDR and response in the Southern Hemisphere.

The road ahead

Completion remains subject to customary approvals. If the transaction closes as expected, Accenture will likely prioritize unified threat intel, shared playbooks, and cross-training to scale incident response coverage. Expect joint offerings around AI-driven SOC automation and identity threat detection, areas where global demand is surging. Given continued breach disclosures across sectors—including newly updated impact tallies from major attacks in North America—boards are likely to keep elevating spend on preparedness, tabletop exercises, and third-party risk programs.

Bottom line: The Accenture CyberCX acquisition is a scale play that cements Accenture as a top-tier managed security partner across APAC, with potential to influence pricing, SLAs, and the competitive landscape for years.