Igniting Sustainability: Chakr’s Major Funding Milestone

Deep-tech powerhouse Chakr Innovation has clinched $23 million in Series C funding, a September 22, 2025, announcement that’s electrifying the cleantech innovation landscape. Led by Iron Pillar, this round catapults the New Delhi-based startup’s total capital to $30 million, arming it to tackle climate challenges head-on. Cleantech innovation, blending materials science with green engineering, is no longer fringe—it’s the $1.7 trillion market projected by BloombergNEF for 2030.

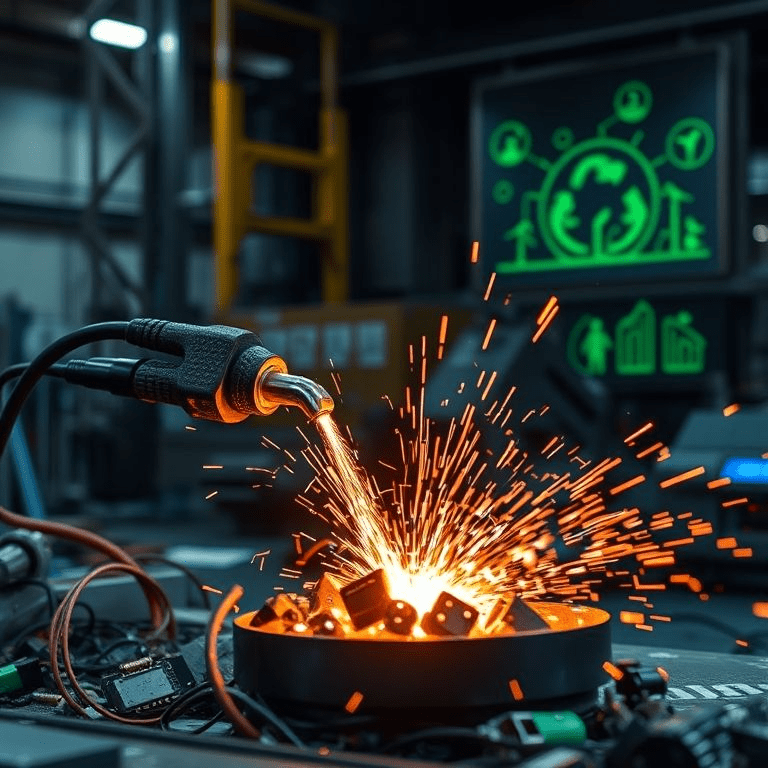

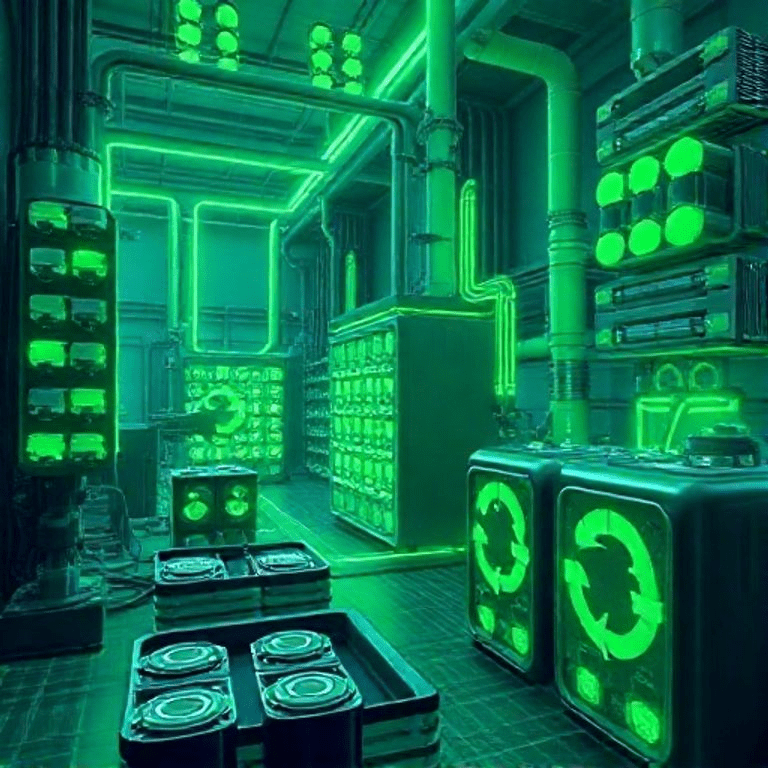

Launched in 2019 by IIT Delhi alumni Kushagra Srivastava and peers, Chakr arose from India’s smog-choked skies and e-waste mountains. Early products like the Chakr Shield—an IoT-enabled retrofit emission control device (RECD) for diesel engines—earned India’s first certification, slashing particulate matter by 90%. Now, with plasma torches recycling metals at 5,000°C, Chakr turns waste into high-purity alloys, disrupting mining’s environmental toll.

This funding arrives as global cleantech investments rebound 25% year-over-year, per PwC, amid COP30 pressures. “This is a major step toward realizing our vision of building world-class cleantech innovation from India,” Srivastava, founder and CEO, proclaimed. Facilities in Gurugram and Pune will expand, but the crown jewel? India’s first dedicated materials science center for critical minerals like lithium and cobalt.

The Funding Breakdown: Strategy and Scale

Iron Pillar, a firm backing India’s tech unicorns, spearheaded the round, drawn to Chakr’s 300% YoY revenue growth. Existing backers SBI Cap Ventures, ONGC, IAN, and Inflexor joined, validating the pivot from emissions to full-cycle recycling. Proceeds target backward integration—securing raw plasma components domestically—and R&D for metal-air batteries, promising 10x energy density over lithium-ion.

Cleantech innovation here means more than gadgets; it’s systemic. Chakr’s remote monitoring system for diesel generators prevents 20% downtime in remote ops, while plasma tech recovers 95% of rare earths from e-waste. International expansion hits Europe and Southeast Asia by Q2 2026, partnering with auto giants for RECD retrofits. In India, where air pollution claims 1.6 million lives yearly (Lancet), this scales impact exponentially.

The round’s timing aligns with U.S. IRA subsidies and EU’s Green Deal, opening export lanes. Chakr’s tech, patented in 15 countries, boasts a 40% cost edge over traditional smelters, per internal benchmarks.

Expert Takes and Industry Echoes

Reactions poured in swiftly. “Chakr exemplifies how cleantech innovation can leapfrog legacy industries,” lauded Priya Singh, sustainability lead at McKinsey India. “Their plasma approach isn’t just green—it’s economically viable, a rare combo.” Iron Pillar’s Rajiv Saini echoed: “In a world racing to net-zero, Chakr’s scalable solutions position India as a cleantech exporter.”

Critics, however, flag energy intensity: Plasma ops guzzle power, though Chakr counters with renewable tie-ins. On LinkedIn, #CleantechInnovation garnered 10,000 engagements, with startups like ReCircle hailing it as “the plasma revolution we needed.” Environmental NGOs like Greenpeace India praised the e-waste focus, urging faster rollout.

Globally, peers like Redwood Materials (U.S.) watch closely; Chakr’s lower labor costs could undercut them in Asia. VC sentiment? “This validates deep-tech bets in emerging markets,” per a Sequoia India report.

Ripple Effects: Transforming Cleantech Ecosystems

For startups, Chakr’s raise spotlights cleantech innovation’s VC appeal—$50 billion flowed globally in H1 2025, up 15% (Crunchbase). In India, it boosts the $10 billion green sector, creating 5,000 jobs in manufacturing alone. Broader impacts? Reduced mining deforestation (Chakr recycles 1,000 tons/month) and lower EV battery costs, aiding adoption in price-sensitive markets.

Challenges include supply chain volatility for rare gases, but Chakr’s vertical integration mitigates. Policy-wise, India’s PLI scheme for clean tech could amplify, potentially tripling output by 2028.

Horizons Ahead: A Greener Tomorrow

Post-funding, Chakr targets $100 million revenue by 2027, with a U.S. pilot for battery recycling. Srivastava envisions cleantech innovation hubs in five cities, fostering 100 startups. As climate deadlines loom, Chakr isn’t just funding rounds—it’s forging a circular economy. From Delhi’s labs to global factories, this $23M is the spark for sustainable fire.