Introduction

In a defining moment for India’s logistics sector, Porter, an on-demand logistics startup, is set to close an extended funding round worth $100–110 million, raising its total to over $300 million. The Porter funding extension, reported on September 8, 2025, underscores the immense investor confidence in India’s logistics-tech ecosystem, which has become a crucial backbone of the country’s booming e-commerce economy.

Porter’s Origins and Business Model

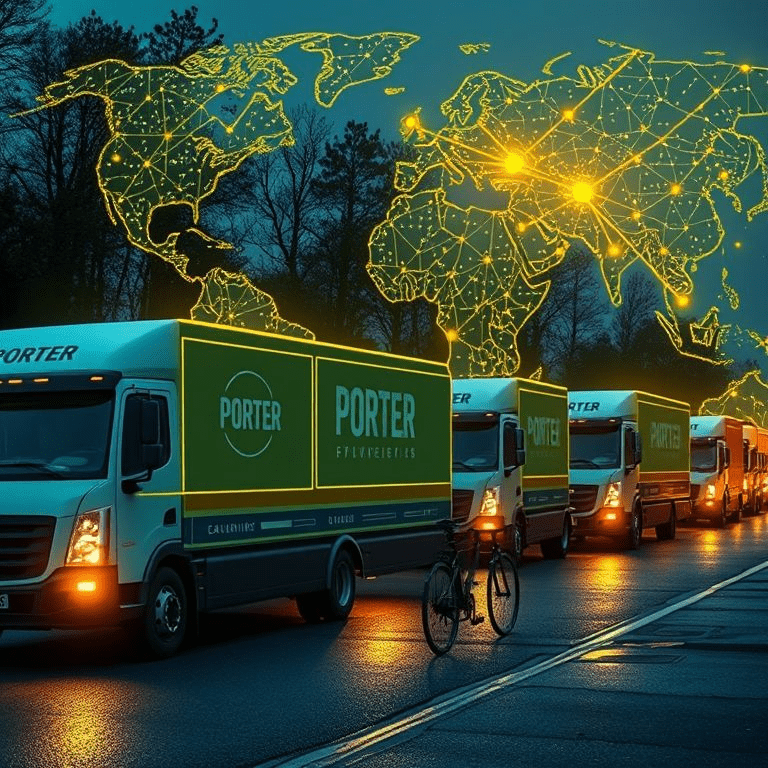

Founded in Bangalore in 2014, Porter has redefined urban freight and logistics. Initially targeting intra-city trucking solutions, the startup built a platform that connects individual drivers and businesses with customers seeking affordable, reliable transport.

The Porter app enables users to book vehicles ranging from mini-trucks to three-wheelers, track deliveries in real time, and make digital payments. Over the years, Porter diversified its services to include enterprise logistics, courier services, and intercity freight solutions, all while maintaining a tech-first, asset-light approach.

Details of the Funding Extension

According to sources, Porter’s latest extension will bring an additional $100–110 million from a mix of new and existing investors, pushing the total raise in this round to $300–310 million. While official investor names remain undisclosed, industry insiders suggest participation from global growth-stage funds with deep interests in India’s logistics market.

This capital infusion follows a string of fundraising successes for Porter, highlighting investor recognition of the startup’s unique positioning in the Indian logistics landscape.

Why the Porter Funding Extension Matters

- Validation of India’s Logistics Tech Sector

The funding reinforces that logistics tech is one of India’s most investable verticals, alongside fintech and edtech. - Scalability in a Fragmented Market

With thousands of small fleet owners and fragmented supply chains, Porter’s platform-based aggregation offers a scalable solution for urban delivery. - Competitive Differentiation

Rivals like Delhivery, Shadowfax, and LetsTransport operate in overlapping segments. Porter’s stronghold in intra-city logistics sets it apart, making investor backing even more critical.

Expert Commentary

Industry experts believe the Porter funding extension is both timely and strategic:

- Rajesh Kumar, logistics consultant: “Porter is solving one of India’s toughest problems—last-mile logistics. The $300M raise gives it the ammunition to scale and invest in technology.”

- Sonal Mehta, venture analyst: “Unlike asset-heavy competitors, Porter’s asset-light model is attractive. Investors see it as a scalable, tech-driven solution for urban logistics challenges.”

- Sustainability Experts point out that the funds could accelerate Porter’s adoption of electric vehicles (EVs) and green logistics hubs, aligning with India’s sustainability goals.

How Porter May Use the Funds

- Geographic Expansion – scaling to Tier-2 and Tier-3 cities with rising e-commerce penetration.

- Tech Innovation – enhancing AI-driven route optimization, predictive demand analytics, and automation.

- Diversification – expanding into warehousing, intercity freight, and international logistics.

- Sustainability – introducing EV fleets and renewable-powered warehouses to meet ESG standards.

Market Context: India’s Logistics Boom

India’s logistics industry, valued at $250–300 billion, is expected to grow at 8–10% annually. With the government investing heavily in infrastructure and e-commerce demand surging, logistics startups like Porter are uniquely positioned to capture value.

The Porter funding extension comes at a time when investors are seeking companies that combine technology with operational excellence. Porter’s model of aggregating fragmented supply through tech-driven efficiency fits the bill.

Impact on the Startup Ecosystem

Porter’s fundraising milestone could:

- Inspire more capital flow into logistics-tech startups.

- Encourage M&A activity, as larger players seek to consolidate fragmented operations.

- Set the stage for IPO discussions, given Porter’s size and market positioning.

Future Outlook

The road ahead for Porter appears promising:

- With $300M+ in backing, Porter could emerge as India’s first urban logistics unicorn focused solely on intra-city transport.

- Expansion into Southeast Asia could follow, with similar urban congestion and e-commerce needs.

- Long-term, Porter may transform into a platform-as-a-service (PaaS) for logistics providers, licensing its tech stack to smaller operators globally.

Conclusion

The Porter funding extension to $300M marks a defining moment for India’s logistics ecosystem. By combining scale, technology, and investor backing, Porter is positioned to transform how goods move across Indian cities. Its journey reflects not only the resilience of India’s startups but also the growing global recognition of logistics tech as a critical pillar of the digital economy.