Introduction

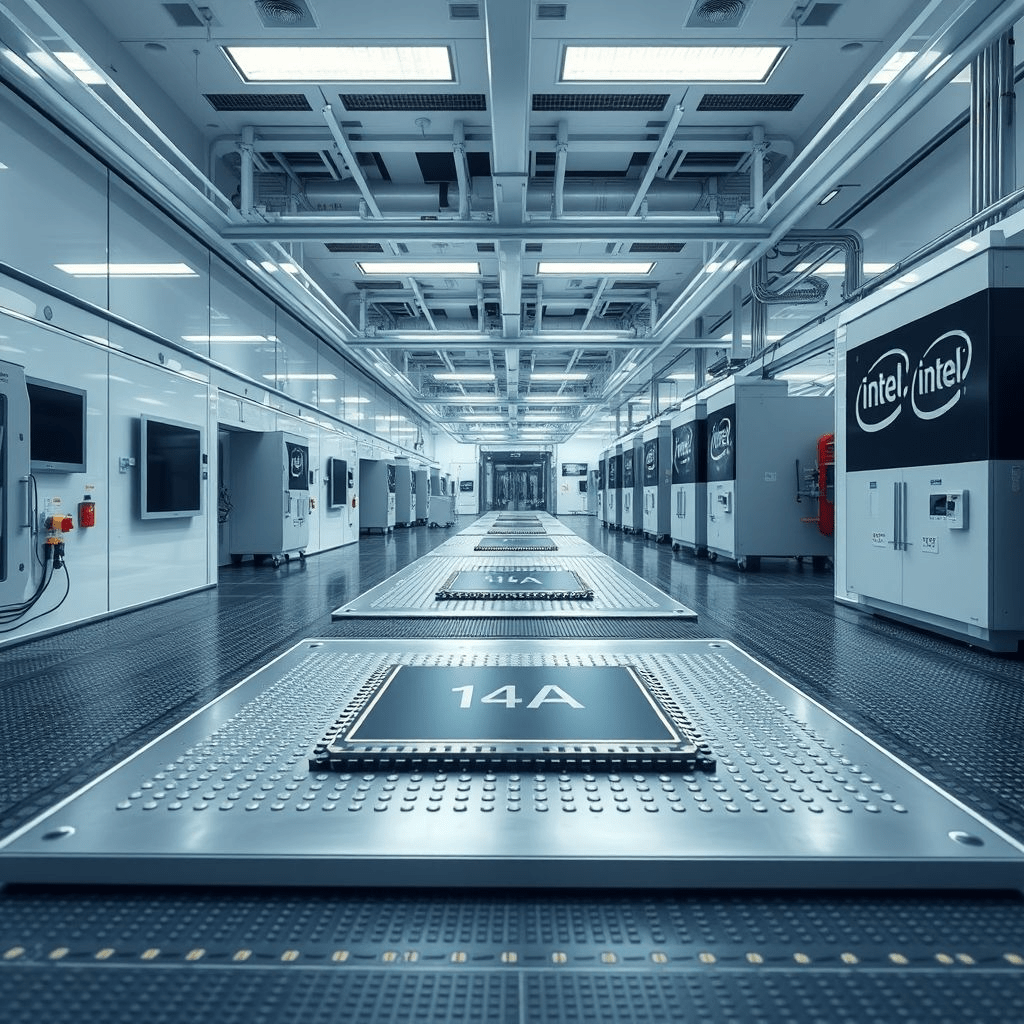

Intel’s new CEO, Lip-Bu Tan, is overseeing a dramatic Intel foundry pivot, shifting the company’s focus to its 14A manufacturing node to compete with TSMC and Nvidia.

Foundry Landscape

Facing a loss to TSMC in advanced nodes, Intel had previously pursued 18A standardization. Tan now suggests reallocating resources and potentially writing off the unsold 18A inventory to concentrate on 14A.

What’s Happening

Reuters sources reveal that Intel is considering a writedown on 18A, refocusing on 14A. This Intel foundry pivot is expected to be finalized by the board in July.

Strategic Motives

The goal: offer external customers advanced yet attainable node tech, easing the path to securing Apple, Nvidia, and others. Tan believes 14A can be more reliably produced and adopted than earlier, riskier nodes.

Market Reaction

Intel shares fell around 5% initially. Analysts note that prioritizing 14A could reposition Intel as a serious contender in the contract foundry market.

Expert Commentary

A semiconductor analyst observed: “A decisive Intel foundry pivot could redefine Intel’s identity—transitioning from PC CPU maker to global chip foundry, not just fabbed for themselves.”

Challenges & Risks

The strategy involves write-off costs, pressure to meet aggressive yield timelines, and overcoming skepticism from prospective OEMs.

Future Outlook

A successful pivot could see Intel winning foundational contracts in the next 12–18 months, while exploring further investment in even more advanced nodes.

Conclusion

Intel’s Intel foundry pivot is a bold strategic gamble. If successful, Intel could emerge as a competitive contract chip manufacturer in a duopoly-dominated market.